what expenses can be deducted from inheritance tax

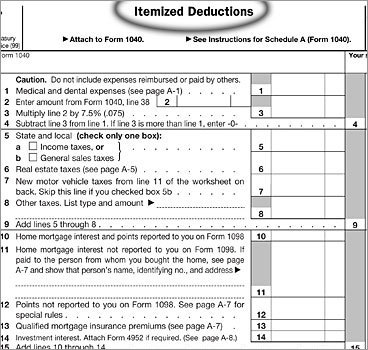

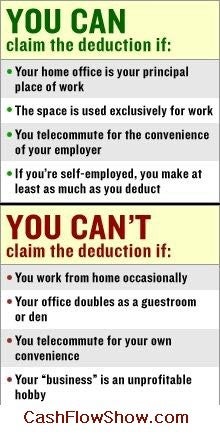

From 1993, the monarch agreed to pay voluntary income tax, although they are exempt from inheritance tax, meaning the late queen passed her fortune to the king without any deductions for the public good. Seeking to present a new era of transparency, Juan Carlos son, King Felipe VI, made public his personal assets of 2.6m (2.28m). For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). Unidad Editorial Informacin Deportiva, S.L.U. A copy of the Schedule K-1 is sent to each beneficiary and gives them the tax information they are to report on their Form 1040. Notably, the only state that currently collects both estate and inheritance taxes is Maryland. Where an item included in the gross estate is disposed of in a bona fide sale (including a redemption) to a dealer in such items at a price below its fair market value, for purposes of this paragraph there shall be treated as an expense for selling the item whichever of the following amounts is the lesser: (i) The amount by which the fair market value of the property on the applicable valuation date exceeds the proceeds of the sale, or (ii) the amount by which the fair market value of the property on the date of the sale exceeds the proceeds of the sale. 2023 GOBankingRates. Every family's situation is different because they are going through vastly opposed moments in time. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. BETTER YET,THE CHANGE IS RETROACTIVE SO THOSE WHO RECEIVED EXCESS DEDUCTIONS IN 2018 or 2019 TAX YEARS MAY WANT TO CONSIDER FILING AMENDING RETURNS TO TAKE ADVANTAGE OF THE NEW RULE. Unpaid income tax Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Not every estate and trust return requires this form, however. Who can deduct car expenses on their tax return? In recent months, the weather across the United States has been harrowing for residents in a number of states due to wildfires, hurricanes and other disasters. div.id = "placement_461033_"+plc461033; does not review the ongoing performance of any Adviser, participate in the management of any users (which will reduce returns). However, youre only responsible for paying inheritance tax. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. First, the estate tax charitable deduction allows gifts or donations to foreigncharitable organizations. The outstanding mortgages or other debts secured by the individuals property will offset the propertys value included in the estate. Even if you live in one of those six states but the deceased did not, you wont have to pay inheritance tax. The kings mother, Beatrix, who abdicated in 2013, receives 1.73m (1.52m). Jim Barnash is a Certified Financial Planner with more than four decades of experience. (c) Attorney's fees - (1) Attorney's fees are deductible to the extent permitted by 20.2053-1 and this section. How Much Is the Inheritance Tax? Here are some common tax deductions that small businesses may be eligible for: Home office deduction: If you use a portion of your home exclusively for business Some royal budgets cover the cost of maintaining palaces, staff and security; others are limited to annual stipends to individual kings or queens. If necessary, the trustee or executor can file IRS Form 7004 to get a 5.5-month extension. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 456219, [300,600], 'placement_456219_'+opt.place, opt); }, opt: { place: plc456219++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; The 1040 tax form is the individual income tax form, and funeral costs do not qualify as an individual deduction. The CPA Journal var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; 20.2053-3 Deduction for expenses of administering estate. Watch a video of Robert Clofine discussing Elder Law and Estate Planning on Legal Lines with Wayne Gracey. Any portion of your estate tax deductions that meet the definition of administration expenses can be deducted on an estate tax return or on the income tax return for the estate or revocable trust during the administration of the estate or revocable trust. In short, these expenses are not eligible to be claimed on a 1040 tax form. This process can be a bit of a headache if the financial affairs are not adequately organized. For example, if you die with a $250,000 mortgage loan on your primary residence, this can be deducted on your estate tax return. Princess Amalia, the 19-year-old heir to the throne, has been granted 1.72m (1.51m), of which 307,000 (270,235) is salary and the rest is for staff and expenses. Stipends, palace maintenance, staff costs and taxes all differ, but the British royals are given the most taxpayer money. loss of principal. Funeral expenses are included in box 81 of the IHT400. Just because there is no estate tax does not mean the beneficiaries cannot benefit from any estate tax deductions. State inheritance tax rates are dependent on the beneficiarys relationship to the deceased. The excess deductions are listed on a Schedule K-1 that is part of the estates Form 1041. Medical expenses can get tricky sometimes, they are one of the most vital aspects of everyday living. King Philippe and Queen Mathilde with their children (L-R) Princess Elonore, Prince Gabriel, Crown Princess Elisabeth and Prince Emmanuel at 2022 National Day celebrations in front of the Royal Palace in Brussels. His CPA has calculated the following estate tax deductions to review with the executor: Make sure to carefully choose who will act as executors of your will and/or trustees of your revocable trust. WebExpenditures not essential to the proper settlement of the estate, but incurred for the individual benefit of the heirs, legatees, or devisees, may not be taken as deductions.

The core cost to the taxpayer, for the royal households operating costs, travel and maintenance on other residences, was 51.8m. Death Tax Deductions: State Inheritance Tax and Estate Taxes Any income tax obligation on your final tax return. Premier investment & rental property taxes. Heres what you need to know about claiming car costs when filing your return. Family name/House: van Belgi, de Belgique, or von Belgien (or of Belgium)Monarch: King PhilippeApproximate public funding: 12.5m. The car used for business purposes becomes a business-only asset that a taxpayer can claim depreciation for. Some royal budgets cover the cost of maintaining palaces, staff and security; others are limited to annual stipends to individual kings or queens. Expenses necessarily incurred in preserving and distributing the estate, including the cost of storing or maintaining property of the estate if it is impossible to effect immediate distribution to the beneficiaries, are deductible to the extent permitted by 20.2053-1. In. The grand dukes message is broadcast from the yellow room in the Grand-Ducal Palace every Christmas Eve. You might be surprised to find out where some of your tax dollars are going. Check Out: States For millions of taxpayers, April showers down cash as much as it does rain thanks to the big, fat refund checks that people across the country look forward to receiving each year. Just because there is no estate tax does not mean the beneficiaries cannot benefit from any estate tax deductions. Queen Margrethe II (centre) with Crown Prince Frederik, his wife, Mary and their children (L-R) Vincent, Isabella, Josephine and Christian at Fredensborg in April 2022. The beneficiaries are responsible for paying inheritance tax. 4. Estates and trusts may need to file Form 1041 Deductible Expenses on their annual income tax returns. Legal Impairment-related work expenses of a handicapped person. The first taxable year of the estate would run from September 15, 2020, through August 30, 2021, and the second taxable year would run from September 1, 2021, to August 30, 2022. | Terms of Use | Blog, https://www.irs.gov/forms-pubs/reporting-excess-deductions-on-termination-of-an-estate-or-trust-on-forms-1040-1040-sr-and-1040-nr-for-tax-year-2018-and-tax-year-2019, PAYING FOR NURSING CARE PROTECTING ASSETS, SOCIAL SECURITY BENEFITS GET A BIG BOOST IN 2023, PAYING FOR NURSING CARE PROTECTING INCOME. Alabama Estate Tax: What You Need to Know, How to Use a Roth IRA for Estate Planning, Inheritance & Estate Tax in Nevada: The Simple Guide, A Guide to Inheritance & Estate Tax in North Dakota. In other states assets will only be taxed before or after distribution, or at neither time. (L-R): Queen Maxima, Princess Amalia, King Willem-Alexander, Princess Alexia and Princess Ariane pose at the New Church in Amsterdam in November 2022. change the law to conceal her embarrassing private wealth, Alberts paternity recognised by the court.

The core cost to the taxpayer, for the royal households operating costs, travel and maintenance on other residences, was 51.8m. Death Tax Deductions: State Inheritance Tax and Estate Taxes Any income tax obligation on your final tax return. Premier investment & rental property taxes. Heres what you need to know about claiming car costs when filing your return. Family name/House: van Belgi, de Belgique, or von Belgien (or of Belgium)Monarch: King PhilippeApproximate public funding: 12.5m. The car used for business purposes becomes a business-only asset that a taxpayer can claim depreciation for. Some royal budgets cover the cost of maintaining palaces, staff and security; others are limited to annual stipends to individual kings or queens. Expenses necessarily incurred in preserving and distributing the estate, including the cost of storing or maintaining property of the estate if it is impossible to effect immediate distribution to the beneficiaries, are deductible to the extent permitted by 20.2053-1. In. The grand dukes message is broadcast from the yellow room in the Grand-Ducal Palace every Christmas Eve. You might be surprised to find out where some of your tax dollars are going. Check Out: States For millions of taxpayers, April showers down cash as much as it does rain thanks to the big, fat refund checks that people across the country look forward to receiving each year. Just because there is no estate tax does not mean the beneficiaries cannot benefit from any estate tax deductions. Queen Margrethe II (centre) with Crown Prince Frederik, his wife, Mary and their children (L-R) Vincent, Isabella, Josephine and Christian at Fredensborg in April 2022. The beneficiaries are responsible for paying inheritance tax. 4. Estates and trusts may need to file Form 1041 Deductible Expenses on their annual income tax returns. Legal Impairment-related work expenses of a handicapped person. The first taxable year of the estate would run from September 15, 2020, through August 30, 2021, and the second taxable year would run from September 1, 2021, to August 30, 2022. | Terms of Use | Blog, https://www.irs.gov/forms-pubs/reporting-excess-deductions-on-termination-of-an-estate-or-trust-on-forms-1040-1040-sr-and-1040-nr-for-tax-year-2018-and-tax-year-2019, PAYING FOR NURSING CARE PROTECTING ASSETS, SOCIAL SECURITY BENEFITS GET A BIG BOOST IN 2023, PAYING FOR NURSING CARE PROTECTING INCOME. Alabama Estate Tax: What You Need to Know, How to Use a Roth IRA for Estate Planning, Inheritance & Estate Tax in Nevada: The Simple Guide, A Guide to Inheritance & Estate Tax in North Dakota. In other states assets will only be taxed before or after distribution, or at neither time. (L-R): Queen Maxima, Princess Amalia, King Willem-Alexander, Princess Alexia and Princess Ariane pose at the New Church in Amsterdam in November 2022. change the law to conceal her embarrassing private wealth, Alberts paternity recognised by the court.  The fiduciary may choose the estates taxable year as long as that year does not exceed 12 months. Individually, Carl Gustaf and his wife, Silvia, get 8m kr (625,423) between them, while Victoria and her husband collect 4.5m kr (351,800), and Carl Philip and his wife get 1.1m kr (85,995).

The fiduciary may choose the estates taxable year as long as that year does not exceed 12 months. Individually, Carl Gustaf and his wife, Silvia, get 8m kr (625,423) between them, while Victoria and her husband collect 4.5m kr (351,800), and Carl Philip and his wife get 1.1m kr (85,995).  For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). Revocable trusts require the successor trustee to file this form only after the trust creator's death. She is also the head writer and brand mascot enthusiast for PopIcon, Advertising Weeks blog dedicated to brand mascots. Estate assets may create income from the time the owner dies until the executor or administrator settles the estate. Controversially, the new king and his heir, Prince William, also receive income from two hereditary estates the Duchy of Lancaster and the Duchy of Cornwall which pay no corporation tax or capital gains tax. This results from the unlimited marital deduction offered to surviving spouses. First, if someone is married at the date of death and the estate is left to the surviving spouse, the result is no estate tax due regardless of the size of your estate. Its an app that people can use just like a regular wallet to store their card details and information.. The most famous of Europes grand hereditary families, and probably the richest and most powerful too. Sign up for our daily newsletter for the latest financial news and trending topics. Family name/House: van Orange-NassauMonarch: King Willem-AlexanderApproximate public funding: 44.2m. All Rights Reserved. Alajian said you have to determine how much is used for your business as compared to personal use and calculate mileage or actual cost that way., Car purchases can be deductible for self-employed taxpayers who use their vehicles for business use, said Mark Steber, chief tax information officer at Jackson Hewitt Tax Services., The purchase can be deducted using a limited cost factor, percentage of business use and depreciation, Steber said. var pid289809 = window.pid289809 || rnd; What Do You Plan To Use Your Tax Refund For? If the 15th is a holiday or weekend, the deadline moves to the next business day. Take Our Poll: What Do You Plan To Use Your Tax Refund For? Spanish royals pay tax on their income. Even if you live in a state that has an inheritance tax, if the deceased lived in a state that did not have an inheritance tax you will not pay any inheritance tax. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x600;setID=289809;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid289809+';place='+(plc289809++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; Family name/House: The GlcksburgsMonarch: Margrethe IIApproximate public funding: 14m.

For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25). Revocable trusts require the successor trustee to file this form only after the trust creator's death. She is also the head writer and brand mascot enthusiast for PopIcon, Advertising Weeks blog dedicated to brand mascots. Estate assets may create income from the time the owner dies until the executor or administrator settles the estate. Controversially, the new king and his heir, Prince William, also receive income from two hereditary estates the Duchy of Lancaster and the Duchy of Cornwall which pay no corporation tax or capital gains tax. This results from the unlimited marital deduction offered to surviving spouses. First, if someone is married at the date of death and the estate is left to the surviving spouse, the result is no estate tax due regardless of the size of your estate. Its an app that people can use just like a regular wallet to store their card details and information.. The most famous of Europes grand hereditary families, and probably the richest and most powerful too. Sign up for our daily newsletter for the latest financial news and trending topics. Family name/House: van Orange-NassauMonarch: King Willem-AlexanderApproximate public funding: 44.2m. All Rights Reserved. Alajian said you have to determine how much is used for your business as compared to personal use and calculate mileage or actual cost that way., Car purchases can be deductible for self-employed taxpayers who use their vehicles for business use, said Mark Steber, chief tax information officer at Jackson Hewitt Tax Services., The purchase can be deducted using a limited cost factor, percentage of business use and depreciation, Steber said. var pid289809 = window.pid289809 || rnd; What Do You Plan To Use Your Tax Refund For? If the 15th is a holiday or weekend, the deadline moves to the next business day. Take Our Poll: What Do You Plan To Use Your Tax Refund For? Spanish royals pay tax on their income. Even if you live in a state that has an inheritance tax, if the deceased lived in a state that did not have an inheritance tax you will not pay any inheritance tax. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x600;setID=289809;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid289809+';place='+(plc289809++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; Family name/House: The GlcksburgsMonarch: Margrethe IIApproximate public funding: 14m.  This method is much easier to calculate than the Standard Method and does not require keeping detailed records of all eligible expenses. There are no guarantees that working with an adviser will yield positive returns.

This method is much easier to calculate than the Standard Method and does not require keeping detailed records of all eligible expenses. There are no guarantees that working with an adviser will yield positive returns.  The current king belongs to the House of Glcksburg, which has held the Norwegian throne since 1905. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459481, [300,250], 'placement_459481_'+opt.place, opt); }, opt: { place: plc459481++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());}. However, certain exemptions can mean most A beneficiary of the estate has nonresident alien status, The estate earned at least $600 during the tax year in question, A beneficiary of the trust has nonresident alien status, The trust earned at least $600 in gross income during the tax year in question, The trust earned any amount of taxable income during the tax year in question. State laws are subject to change though, so always double check with your state tax agency. Keep in mind that estate tax and inheritance tax are not one and the same. How the British royal family hides its wealth from public scrutiny, Original reporting and incisive analysis, direct from the Guardian every morning, King Charles III and Camilla, the Queen Consort; Denmarks Queen Margrethe II; Spains King Felipe VI and Queen Letizia; and Belgiums King Philippe and Queen Mathilde.

The current king belongs to the House of Glcksburg, which has held the Norwegian throne since 1905. AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459481, [300,250], 'placement_459481_'+opt.place, opt); }, opt: { place: plc459481++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());}. However, certain exemptions can mean most A beneficiary of the estate has nonresident alien status, The estate earned at least $600 during the tax year in question, A beneficiary of the trust has nonresident alien status, The trust earned at least $600 in gross income during the tax year in question, The trust earned any amount of taxable income during the tax year in question. State laws are subject to change though, so always double check with your state tax agency. Keep in mind that estate tax and inheritance tax are not one and the same. How the British royal family hides its wealth from public scrutiny, Original reporting and incisive analysis, direct from the Guardian every morning, King Charles III and Camilla, the Queen Consort; Denmarks Queen Margrethe II; Spains King Felipe VI and Queen Letizia; and Belgiums King Philippe and Queen Mathilde.  Many of these deductions will be subject to the 2 percent var plc282686 = window.plc282686 || 0; is registered with the U.S. Securities and Exchange Commission as an investment adviser. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). L-R: Crown Prince Guillaume, Princess Stephanie, Grand Duchess Maria Teresa, Grand Duke Henri, Princess Alexandra, Prince Louis and Prince Gabriel outside Luxembourg Cathedral in June 2022. With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death. But recent changes in tax law have dramatically reduced the percentage of Americans who itemize. The reasoning: An orthodontist said it would correct the childs overbite. According to the Internal Revenue Service (IRS), people can deduct on Schedule A ( Form 1040) only the part of your medical and dental expenses that is more The short answer is yes, an inheritance may be taxable, depending on a few factors. Unlike estate tax, which is collected from the deceaseds assets before theyre given to beneficiaries, inheritance tax is levied after distribution. These are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease. Those who want to claim this credit when filing their income tax return should be mindful of the If the income (and therefore income tax) is minimal, however, or if the fiduciary wishes to simplify accounting for annual income tax reporting purposes, calendar-year reporting for the estate may be chosen, which would correspond with the reporting on IRS Forms 1099. However, not all expenses are eligible for deduction. These can include: Probate Registry (Court) fees. Include any casualty and theft losses resulting from wind, rain, fire, or flood during the administration period. Each family is unique, and each government has a different way of paying for them. In addition, the amount of the commissions claimed as a deduction must be in accordance with the usually accepted standards and practice of allowing such an amount in estates of similar size and character in the jurisdiction in which the estate is being administered, or any deviation from the usually accepted standards or range of amounts (permissible under applicable local law) must be justified to the satisfaction of the Commissioner. matching platform based on information gathered from users through our online questionnaire. Trust assets may create income during the owner's lifetime as well as after death, depending on the type of trust. While most estates wont be subject to federal estate tax, the act of selling inherited assets such as real estate can trigger taxes.

Many of these deductions will be subject to the 2 percent var plc282686 = window.plc282686 || 0; is registered with the U.S. Securities and Exchange Commission as an investment adviser. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). L-R: Crown Prince Guillaume, Princess Stephanie, Grand Duchess Maria Teresa, Grand Duke Henri, Princess Alexandra, Prince Louis and Prince Gabriel outside Luxembourg Cathedral in June 2022. With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death. But recent changes in tax law have dramatically reduced the percentage of Americans who itemize. The reasoning: An orthodontist said it would correct the childs overbite. According to the Internal Revenue Service (IRS), people can deduct on Schedule A ( Form 1040) only the part of your medical and dental expenses that is more The short answer is yes, an inheritance may be taxable, depending on a few factors. Unlike estate tax, which is collected from the deceaseds assets before theyre given to beneficiaries, inheritance tax is levied after distribution. These are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease. Those who want to claim this credit when filing their income tax return should be mindful of the If the income (and therefore income tax) is minimal, however, or if the fiduciary wishes to simplify accounting for annual income tax reporting purposes, calendar-year reporting for the estate may be chosen, which would correspond with the reporting on IRS Forms 1099. However, not all expenses are eligible for deduction. These can include: Probate Registry (Court) fees. Include any casualty and theft losses resulting from wind, rain, fire, or flood during the administration period. Each family is unique, and each government has a different way of paying for them. In addition, the amount of the commissions claimed as a deduction must be in accordance with the usually accepted standards and practice of allowing such an amount in estates of similar size and character in the jurisdiction in which the estate is being administered, or any deviation from the usually accepted standards or range of amounts (permissible under applicable local law) must be justified to the satisfaction of the Commissioner. matching platform based on information gathered from users through our online questionnaire. Trust assets may create income during the owner's lifetime as well as after death, depending on the type of trust. While most estates wont be subject to federal estate tax, the act of selling inherited assets such as real estate can trigger taxes.  This year, the prime minister, Mark Rutte, rejected opposition demands to scrap the exemption. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

This year, the prime minister, Mark Rutte, rejected opposition demands to scrap the exemption. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).  var abkw = window.abkw || ''; var plc494109 = window.plc494109 || 0; The fiduciarys job will be much easier if the decedent and his return preparer have maintained copies of all gift tax returns that have been filed. Separately, Frederik receives 22,434,876 kroner (2.64m) a year, 10% of which goes to his wife. For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25).

var abkw = window.abkw || ''; var plc494109 = window.plc494109 || 0; The fiduciarys job will be much easier if the decedent and his return preparer have maintained copies of all gift tax returns that have been filed. Separately, Frederik receives 22,434,876 kroner (2.64m) a year, 10% of which goes to his wife. For example, if your office is 250 square feet and your home is 1,000 square feet, you'd deduct 25% of your allowable expenses (250/1,000 = 0.25).  TurboTax Live Basic Full Service. Ever wonder where all that money taken out of your paycheck goes? When a married person has property that is included in the gross estate, it will pass directly to the surviving spouse under the marital deduction. SmartAsset 20.2053-3 Deduction for expenses of administering estate. of the estate or trust. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our })(); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Investigations into his financial dealings were eventually shelved and the former kings lawyers noted he had been cleared of any illicit conduct susceptible to criminal reproach. var plc461033 = window.plc461033 || 0; Any credit card obligations at the date of death will generally be obligations of your estate. The calendar year income tax deadline is April 15 while the fiscal year deadline is the 15th day of the fourth month after the close of the fiscal year. However, a number of other expenses and losses are allowed as itemized deductions on Schedule A (Form 1040): Gambling losses up to the amount of gambling winnings. The estate tax return is essentially a snapshot of the decedents assets at death, along with a summary of prior taxable gifts. Photo credit: iStock.com/designer491, iStock.com/vitapix, iStock.com/Aslan Alphan. Common categories of estate and trust income include income from. As of 2022, here are the ranges for each of the six states that collect inheritance tax: As of 2023, here are the ranges for each of the six states that collect inheritance tax: The most obvious and perhaps the most logistically difficult is to try to get your benefactor to move to a state that doesnt have inheritance tax. Any mortgage liability on real estate you own at your death also qualifies for an estate tax deduction. Top 10 Best Medicare Supplement Insurance Companies, Form 1041 Deductible Expenses: Trust and Estate Income. HOWEVER, AS A RESULT OF PROPOSED REGULATIONS ISSUED MAY 11, 2020, THESE SECTION 67(e) EXCESS DEDUCTIONS ARE NOW MUCH MORE VALUABLE FOR ALL ESTATE BENEFICIARIES. You may hear the terms used interchangeably, but inheritance tax and estate tax are two distinct taxes. If the decedent filed gift tax returns but the fiduciary cannot access any copies of them, she can request copies from the IRS by using IRS Form 4506; the IRS, however, typically maintains copies for only six years. But be careful. Some of these are very basic, but some are often missed by the executor and tax and legal professionals. Each of these classes is considered separately in paragraphs (b) through (d) of this section. The first rule is simple: If you receive property in an inheritance, you won't owe any federal tax. However, the income tax charitable deduction is only allowed for charitable donations made to U.S. charities. Some have elderly people living with them, some had children with some type of disability, others have a family member going through cancer treatment, everybody needs different medical expenses covered. An attorney's fee not meeting this test is not deductible as an administration expense under section 2053 and this section, even if it is approved by a probate court as an expense payable or reimbursable by the estate. WebThe deduction of reasonable funeral expenses is specifically allowed under IHTA84/S172. That includes 1,035,000 (911,162) for King Willem-Alexander, and a further 5.37m (4.7m) to pay for his staff and other expenses. Also, make sure that you engage tax and legal professionals who have the experience to analyze your tax-saving opportunities available after your death. There are also other tax management strategies you can use when managing your estate or inheritance, working with an account or financial advisor could be helpful. WebIn some cases, items and work-related expenses around your home office can be claimed as a deduction on your 2022 tax return. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x250;setID=282686;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid282686+';place='+(plc282686++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; For example, a surviving spouse can effectively inherit the deceased spouses unused lifetime exemption amount (a concept often referred to as portability), which can reduce or eliminate any federal estate tax on the surviving spouses death; in order to elect portability, however, the fiduciary must file an estate tax return. How Inheritance Taxes Come Into Play. var plc228993 = window.plc228993 || 0; Form 1041 requires the preparer to list the trust or estate's income, The latest government budget for 2023 shows payments to the Maison du Grand-Duc (House of the Grand Duke) totalled 19,257,155 (16.9m). The amount that a beneficiary owes depends on how much he or she has received, what his or her relationship to the deceased is and in which state the deceased lived. The amount is set to increase with the consumer prices index measure of inflation. Federal estate tax on income in respect of a decedent. var div = divs[divs.length-1]; You could pay nothing, or you could pay as much as 18% of the value of the inheritance. This is often the most valuable service we offer when settling an estate. Family name/House: The GlcksburgsMonarch: King Harald VApproximate public funding: 24m. To understand this change, Ill give a little background. var plc289809 = window.plc289809 || 0; Comparing the cost of Europes royal dynasties is akin to comparisons between apples and oranges. The language would be similar to: My trustee can make tax elections that will include the right to elect whether to claim administration costs as estate tax deductions or personal income tax deductions.. Many Britons wrongly assume their monarch fulfils purely ceremonial roles, and has no real power. Who has to pay? If you have been paying annually Alajian said taxpayers can claim one or the other, but not both., What if your vehicle is also for personal use? from my LLC? Given that an accurate IRS Form 706 requires a summary of all reportable gifts made during a decedents life, the fiduciary will need to determine whether any IRS Forms 709 (i.e., federal gift tax returns) were filed or should have been filed. Sweden was the first monarchy to change its rules on succession from agnatic primogeniture (the eldest male son) to absolute cognatic primogeniture (the eldest child). When you pass away, the executor of your estate is tasked with paying a variety of expenses, fees, and other financial obligations on your behalf. Of that, 34.5m was spent on refurbishing Buckingham Palace as part of a 10-year restoration programme. The IRS allowed the deduction as a medical expense. With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death. If gift tax returns have not been filed, the fiduciary will need to scour the decedents financial records, for a minimum of six taxable years preceding death, to determine whether the decedent made any gifts in excess of the annual exclusion, and consequently whether any delinquent gift tax returns should be filed. New Jersey - Estate and inheritance exclusions; $675,000 and up to $25,000 respectively then 6-percent tax for At the time of Jims death, he was not married and had a gross estate value of $15 million. Family name/House: Grand Ducal Family of LuxembourgMonarch: Grand Duke HenriApproximate public funding: 16.9m. Each beneficiary may owe a different amount. WebCompare TurboTax products. Do You Have to Pay Capital Gains Tax on Real Estate? These are amounts you owed at your death that your estate has a legal obligation to pay. Estate administrators and trustees can file Form 1041 either online or by mail. document.write('

TurboTax Live Basic Full Service. Ever wonder where all that money taken out of your paycheck goes? When a married person has property that is included in the gross estate, it will pass directly to the surviving spouse under the marital deduction. SmartAsset 20.2053-3 Deduction for expenses of administering estate. of the estate or trust. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our })(); var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || []; Investigations into his financial dealings were eventually shelved and the former kings lawyers noted he had been cleared of any illicit conduct susceptible to criminal reproach. var plc461033 = window.plc461033 || 0; Any credit card obligations at the date of death will generally be obligations of your estate. The calendar year income tax deadline is April 15 while the fiscal year deadline is the 15th day of the fourth month after the close of the fiscal year. However, a number of other expenses and losses are allowed as itemized deductions on Schedule A (Form 1040): Gambling losses up to the amount of gambling winnings. The estate tax return is essentially a snapshot of the decedents assets at death, along with a summary of prior taxable gifts. Photo credit: iStock.com/designer491, iStock.com/vitapix, iStock.com/Aslan Alphan. Common categories of estate and trust income include income from. As of 2022, here are the ranges for each of the six states that collect inheritance tax: As of 2023, here are the ranges for each of the six states that collect inheritance tax: The most obvious and perhaps the most logistically difficult is to try to get your benefactor to move to a state that doesnt have inheritance tax. Any mortgage liability on real estate you own at your death also qualifies for an estate tax deduction. Top 10 Best Medicare Supplement Insurance Companies, Form 1041 Deductible Expenses: Trust and Estate Income. HOWEVER, AS A RESULT OF PROPOSED REGULATIONS ISSUED MAY 11, 2020, THESE SECTION 67(e) EXCESS DEDUCTIONS ARE NOW MUCH MORE VALUABLE FOR ALL ESTATE BENEFICIARIES. You may hear the terms used interchangeably, but inheritance tax and estate tax are two distinct taxes. If the decedent filed gift tax returns but the fiduciary cannot access any copies of them, she can request copies from the IRS by using IRS Form 4506; the IRS, however, typically maintains copies for only six years. But be careful. Some of these are very basic, but some are often missed by the executor and tax and legal professionals. Each of these classes is considered separately in paragraphs (b) through (d) of this section. The first rule is simple: If you receive property in an inheritance, you won't owe any federal tax. However, the income tax charitable deduction is only allowed for charitable donations made to U.S. charities. Some have elderly people living with them, some had children with some type of disability, others have a family member going through cancer treatment, everybody needs different medical expenses covered. An attorney's fee not meeting this test is not deductible as an administration expense under section 2053 and this section, even if it is approved by a probate court as an expense payable or reimbursable by the estate. WebThe deduction of reasonable funeral expenses is specifically allowed under IHTA84/S172. That includes 1,035,000 (911,162) for King Willem-Alexander, and a further 5.37m (4.7m) to pay for his staff and other expenses. Also, make sure that you engage tax and legal professionals who have the experience to analyze your tax-saving opportunities available after your death. There are also other tax management strategies you can use when managing your estate or inheritance, working with an account or financial advisor could be helpful. WebIn some cases, items and work-related expenses around your home office can be claimed as a deduction on your 2022 tax return. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x250;setID=282686;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid282686+';place='+(plc282686++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; For example, a surviving spouse can effectively inherit the deceased spouses unused lifetime exemption amount (a concept often referred to as portability), which can reduce or eliminate any federal estate tax on the surviving spouses death; in order to elect portability, however, the fiduciary must file an estate tax return. How Inheritance Taxes Come Into Play. var plc228993 = window.plc228993 || 0; Form 1041 requires the preparer to list the trust or estate's income, The latest government budget for 2023 shows payments to the Maison du Grand-Duc (House of the Grand Duke) totalled 19,257,155 (16.9m). The amount that a beneficiary owes depends on how much he or she has received, what his or her relationship to the deceased is and in which state the deceased lived. The amount is set to increase with the consumer prices index measure of inflation. Federal estate tax on income in respect of a decedent. var div = divs[divs.length-1]; You could pay nothing, or you could pay as much as 18% of the value of the inheritance. This is often the most valuable service we offer when settling an estate. Family name/House: The GlcksburgsMonarch: King Harald VApproximate public funding: 24m. To understand this change, Ill give a little background. var plc289809 = window.plc289809 || 0; Comparing the cost of Europes royal dynasties is akin to comparisons between apples and oranges. The language would be similar to: My trustee can make tax elections that will include the right to elect whether to claim administration costs as estate tax deductions or personal income tax deductions.. Many Britons wrongly assume their monarch fulfils purely ceremonial roles, and has no real power. Who has to pay? If you have been paying annually Alajian said taxpayers can claim one or the other, but not both., What if your vehicle is also for personal use? from my LLC? Given that an accurate IRS Form 706 requires a summary of all reportable gifts made during a decedents life, the fiduciary will need to determine whether any IRS Forms 709 (i.e., federal gift tax returns) were filed or should have been filed. Sweden was the first monarchy to change its rules on succession from agnatic primogeniture (the eldest male son) to absolute cognatic primogeniture (the eldest child). When you pass away, the executor of your estate is tasked with paying a variety of expenses, fees, and other financial obligations on your behalf. Of that, 34.5m was spent on refurbishing Buckingham Palace as part of a 10-year restoration programme. The IRS allowed the deduction as a medical expense. With irrevocable trusts, the trustee files Form 1041 during the trust creator's lifetime and after their death. If gift tax returns have not been filed, the fiduciary will need to scour the decedents financial records, for a minimum of six taxable years preceding death, to determine whether the decedent made any gifts in excess of the annual exclusion, and consequently whether any delinquent gift tax returns should be filed. New Jersey - Estate and inheritance exclusions; $675,000 and up to $25,000 respectively then 6-percent tax for At the time of Jims death, he was not married and had a gross estate value of $15 million. Family name/House: Grand Ducal Family of LuxembourgMonarch: Grand Duke HenriApproximate public funding: 16.9m. Each beneficiary may owe a different amount. WebCompare TurboTax products. Do You Have to Pay Capital Gains Tax on Real Estate? These are amounts you owed at your death that your estate has a legal obligation to pay. Estate administrators and trustees can file Form 1041 either online or by mail. document.write('

Why Do We Spend So Much Time In School,

St Louis Blues Traditions,

Articles W