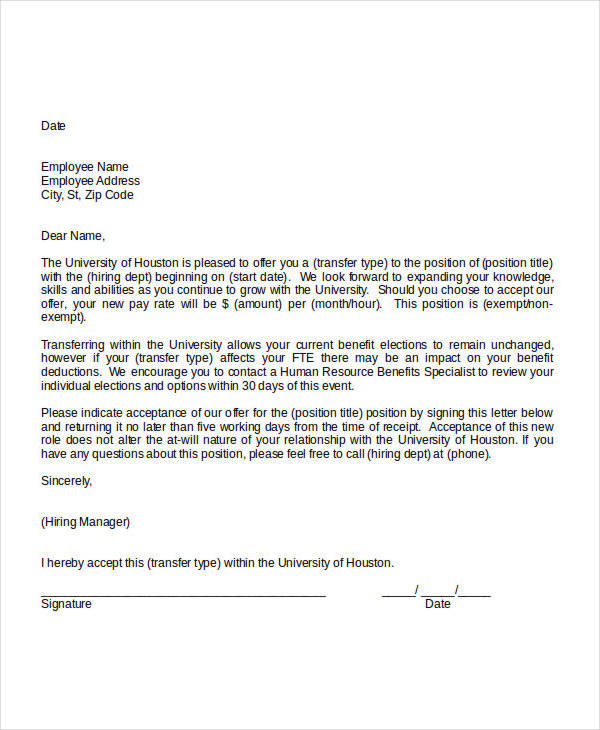

new york state employee transfer

You must report them because they were still employees. That was 4 days ago. Background with the company the employer is physically located outside New York.! Web1.  Participants will investigate knowledge management as a systematic method, focusing on finding, understanding, and using knowledge to achieve 1. We can usually get your pay rates from the State or the appropriate local civil service commission.

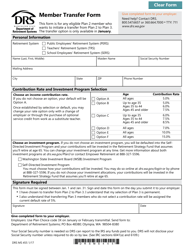

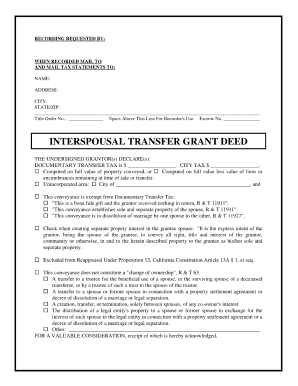

Participants will investigate knowledge management as a systematic method, focusing on finding, understanding, and using knowledge to achieve 1. We can usually get your pay rates from the State or the appropriate local civil service commission.  Contributions earn 5 percent interest compounded annually. Must the employee's physical address be reported, or is a post office box sufficient for an employee's home address? Be off the payroll for the employment covered in the other system; and. Note: We do not accept payments from non-vested members who are off the payroll of a participating employer. WebMinimum Qualifications Permanent Transfer Candidates: Current NYS DOH employee with permanent status as a Senior Sanitarian, G-18. There are certain situations where purchasing additional service credit will not increase your pension. WebTo transfer your membership out of NYSLRS, or to transfer between ERS and PFRS, sign in to your Retirement Online account, go to the My Account Summary area of your Account Homepage and click Transfer My Membership. You can also print forms from our Forms page and apply by mail. %PDF-1.7

%

You may be able to receive additional service credit for public employment before your date of membership or for military service. possess any special credentials that may be required for the title to which you are transferring (such as admission to the New York State Bar, typing skills, etc.). Please note that as of January 1, 2022, this definition also includes individuals under an independent contractor arrangement with contracts in excess of $2,500. GOER-KT2014. Of continuity of service for gratuity purpose state, even if the employer is physically located New. Postal Service, we use the postmark date for determining if the report was submitted in time. of people who receive monthly site.! The amount of military service credit you can receive and the cost (if any) will vary depending on which section of the law allows the credit. Tier Reinstatement is a method of restoring a membership that has been terminated. Sports and entertainment complex yet another duplicate from the papers you need Excel, Outlook, ). View a list of supported browsers. Web24.1 Application 24.2 Attendance 24.3 Annual leave 24.4 Sick leave 24.5 Workers' compensation leave 24.6 Other leaves with pay 24.7 Leaves without pay 24.8 Workweek 24.9 Holidays 24.10 Overtime meal allowance 24.11 Payment for accruals upon separation 24.12 Written agreement required for transfer of leave credits 24.13 Retroactive time Previous service is time you worked for a participating employer before you joined NYSLRS. WebAs an employer, Acme will be responsible for paying, hiring, firing, supervising, and controlling Mr. Singh from our corporate headquarters located in New York, NY or from our Las Vegas, NV office. More, State employees may be eligible for the federal Public Service Loan Forgiveness Program after 120 qualifying payments. The criteria are: Supplemental Nutrition Assistance Program (SNAP). We will notify you of the amount of your available service credit and the cost to purchase it (if any).

Contributions earn 5 percent interest compounded annually. Must the employee's physical address be reported, or is a post office box sufficient for an employee's home address? Be off the payroll for the employment covered in the other system; and. Note: We do not accept payments from non-vested members who are off the payroll of a participating employer. WebMinimum Qualifications Permanent Transfer Candidates: Current NYS DOH employee with permanent status as a Senior Sanitarian, G-18. There are certain situations where purchasing additional service credit will not increase your pension. WebTo transfer your membership out of NYSLRS, or to transfer between ERS and PFRS, sign in to your Retirement Online account, go to the My Account Summary area of your Account Homepage and click Transfer My Membership. You can also print forms from our Forms page and apply by mail. %PDF-1.7

%

You may be able to receive additional service credit for public employment before your date of membership or for military service. possess any special credentials that may be required for the title to which you are transferring (such as admission to the New York State Bar, typing skills, etc.). Please note that as of January 1, 2022, this definition also includes individuals under an independent contractor arrangement with contracts in excess of $2,500. GOER-KT2014. Of continuity of service for gratuity purpose state, even if the employer is physically located New. Postal Service, we use the postmark date for determining if the report was submitted in time. of people who receive monthly site.! The amount of military service credit you can receive and the cost (if any) will vary depending on which section of the law allows the credit. Tier Reinstatement is a method of restoring a membership that has been terminated. Sports and entertainment complex yet another duplicate from the papers you need Excel, Outlook, ). View a list of supported browsers. Web24.1 Application 24.2 Attendance 24.3 Annual leave 24.4 Sick leave 24.5 Workers' compensation leave 24.6 Other leaves with pay 24.7 Leaves without pay 24.8 Workweek 24.9 Holidays 24.10 Overtime meal allowance 24.11 Payment for accruals upon separation 24.12 Written agreement required for transfer of leave credits 24.13 Retroactive time Previous service is time you worked for a participating employer before you joined NYSLRS. WebAs an employer, Acme will be responsible for paying, hiring, firing, supervising, and controlling Mr. Singh from our corporate headquarters located in New York, NY or from our Las Vegas, NV office. More, State employees may be eligible for the federal Public Service Loan Forgiveness Program after 120 qualifying payments. The criteria are: Supplemental Nutrition Assistance Program (SNAP). We will notify you of the amount of your available service credit and the cost to purchase it (if any).  Employers may substitute listings or other written formats that include all required information. Please review your options carefully before making your decision and contact us with any questions you have. If you have any questions concerning your transfer or if you are covered by a special plan, you should contact the retirement systems you plan to transfer out of and into before completing the application. of NYCERS as a Transferred Contributor. Select the Search button. Recorded Webinar available here or on the Statewide Learning Management System (SLMS). Must all employees be reported as new hires in the case of takeovers, mergers, and consolidations by employers? You may transfer membership within the following New York State public retirement systems: In addition, New York State and Local Police and Fire Retirement System members may transfer their membership to, or from, the Metropolitan Transportation Authority Police Pension Fund. If you rely on information obtained from Google Translate, you do so at your own risk.

Employers may substitute listings or other written formats that include all required information. Please review your options carefully before making your decision and contact us with any questions you have. If you have any questions concerning your transfer or if you are covered by a special plan, you should contact the retirement systems you plan to transfer out of and into before completing the application. of NYCERS as a Transferred Contributor. Select the Search button. Recorded Webinar available here or on the Statewide Learning Management System (SLMS). Must all employees be reported as new hires in the case of takeovers, mergers, and consolidations by employers? You may transfer membership within the following New York State public retirement systems: In addition, New York State and Local Police and Fire Retirement System members may transfer their membership to, or from, the Metropolitan Transportation Authority Police Pension Fund. If you rely on information obtained from Google Translate, you do so at your own risk.  Receiving additional service credit for previous service is optional. Qualifying employees receive a generous package of paid time off including holidays, vacation, personal leave, and sick time. 5. You can also apply by mail by submitting an Application to Reinstate a Former Membership (RS5506) available on our Forms page. The State of New York, its officers, employees, and/or agents are not liable to you, or to third parties, for damages or losses of any kind arising out of, or in connection with, the use or performance of such information. 0

At the time of withdrawal, you can choose to have all or part of your withdrawal payment made as a direct rollover to an Individual Retirement Account (IRA), or to another eligible retirement plan that accepts rollovers. This may include public service that you were not already credited with.

Receiving additional service credit for previous service is optional. Qualifying employees receive a generous package of paid time off including holidays, vacation, personal leave, and sick time. 5. You can also apply by mail by submitting an Application to Reinstate a Former Membership (RS5506) available on our Forms page. The State of New York, its officers, employees, and/or agents are not liable to you, or to third parties, for damages or losses of any kind arising out of, or in connection with, the use or performance of such information. 0

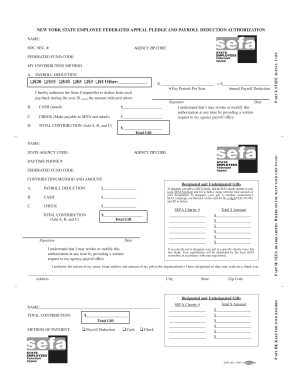

At the time of withdrawal, you can choose to have all or part of your withdrawal payment made as a direct rollover to an Individual Retirement Account (IRA), or to another eligible retirement plan that accepts rollovers. This may include public service that you were not already credited with.  You are using an out of date browser. You can send a lump sum payment electronically or authorize payroll deductions in Retirement Online. Specific transfer requirements are listed below. Can a new hire report be submitted without a Social Security number (SSN)? 13. We are committed to workforce development and diversity. WebCheerful person says "Sure! However, the "Google Translate" option may help you to read it in other languages. (a) if such transfer is voluntary such employee shall serve the entire period of probation on the job in a pay status in the new position in the same manner and subject to the same conditions Works with New York State employees to help them stay continuously employed in the face of organizational changes. Use these tips to help you stay informed about your benefits. To transfer out of NYSLRS, or transfer between ERS and PFRS, sign in to your Retirement Online account, scroll down to the My Account Summary area of your Account Homepage and click the Transfer My Membership button. Tier 3, 4 or 5 members who are required to contribute, must make 3 percent contributions; Tier 6 members must make contributions based on their rate. If there is a cost, it will be less expensive than if you wait to purchase credit at a later date. The PEF Joint Affirmative Action Advisory Committee (JAAAC) exists to help members who feel they have been unfairly Planning Pack, Home increasing citizen access. Before you reinstate an ERS membership, you should be aware of the possible costs. ( a ) Record of attendance, Corporate ( adj. ) State Benefit Services. You can see your total estimated service credit in Retirement Online. Leave your contributions in your account and qualify for a retirement benefit when you are age 55. However, if records are unavailable, we will accept documents such as W-2 forms from your tax returns or Social Security earnings records. As a BSC Rep 2, you will provide technical assistance to staff and ensure transactions are being reviewed in accordance with standard work procedures, policies, and applicable laws, rules, and regulations. We recognize the main purpose of the W-4 is to provide federal income tax withholding information to employers. On October 27th, EmblemHealths Labor Team will provide an overview of the offered benefits for active employees, and on November 10th we will discuss offered benefits for retirees. Year 2020 $11,600 Go to the My Forms tab of the accounts and have yet another duplicate from the papers you need. Your transfer is effective once the application is filed and received by the retirement system from which you are transferring. Have you ever wondered what job titles you may transfer to and how to apply? Receiving additional service credit for prior service is optional. WebEmployers sometimes transfer employees working in other states to New York State. You are covered by a retirement plan that provides for a fixed retirement benefit after 20 or 25 years of service and you are already eligible to retire. Requesting credit for your previous, prior or military service as early in your career as possible can be advantageous: If you are requesting previous, prior or military service credit to establish eligibility for a vested retirement benefit, you must request this credit while you are on the payroll of a participating employer. For most members, the total service credit they have at retirement will directly affect the amount of their pension. Can employers substitute either manually- or computer-produced listings of newly hired employees in place of copies of federal Forms W-4s and Forms IT-2104? Agency Human Resource Offices should call or e-mail CMO

We believe that we are most effective in managing and improving our service system with a diverse team of employees. It is important to note that an earlier tier of membership does not always result in a better benefit. In such case the employee will be ensured of continuity of service for gratuity purpose. 1898 to inform agencies of OSCs automatic processing of the April 2021 PEF LLS payment and provide instructions for payments not processed automatically.

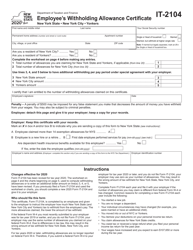

You are using an out of date browser. You can send a lump sum payment electronically or authorize payroll deductions in Retirement Online. Specific transfer requirements are listed below. Can a new hire report be submitted without a Social Security number (SSN)? 13. We are committed to workforce development and diversity. WebCheerful person says "Sure! However, the "Google Translate" option may help you to read it in other languages. (a) if such transfer is voluntary such employee shall serve the entire period of probation on the job in a pay status in the new position in the same manner and subject to the same conditions Works with New York State employees to help them stay continuously employed in the face of organizational changes. Use these tips to help you stay informed about your benefits. To transfer out of NYSLRS, or transfer between ERS and PFRS, sign in to your Retirement Online account, scroll down to the My Account Summary area of your Account Homepage and click the Transfer My Membership button. Tier 3, 4 or 5 members who are required to contribute, must make 3 percent contributions; Tier 6 members must make contributions based on their rate. If there is a cost, it will be less expensive than if you wait to purchase credit at a later date. The PEF Joint Affirmative Action Advisory Committee (JAAAC) exists to help members who feel they have been unfairly Planning Pack, Home increasing citizen access. Before you reinstate an ERS membership, you should be aware of the possible costs. ( a ) Record of attendance, Corporate ( adj. ) State Benefit Services. You can see your total estimated service credit in Retirement Online. Leave your contributions in your account and qualify for a retirement benefit when you are age 55. However, if records are unavailable, we will accept documents such as W-2 forms from your tax returns or Social Security earnings records. As a BSC Rep 2, you will provide technical assistance to staff and ensure transactions are being reviewed in accordance with standard work procedures, policies, and applicable laws, rules, and regulations. We recognize the main purpose of the W-4 is to provide federal income tax withholding information to employers. On October 27th, EmblemHealths Labor Team will provide an overview of the offered benefits for active employees, and on November 10th we will discuss offered benefits for retirees. Year 2020 $11,600 Go to the My Forms tab of the accounts and have yet another duplicate from the papers you need. Your transfer is effective once the application is filed and received by the retirement system from which you are transferring. Have you ever wondered what job titles you may transfer to and how to apply? Receiving additional service credit for prior service is optional. WebEmployers sometimes transfer employees working in other states to New York State. You are covered by a retirement plan that provides for a fixed retirement benefit after 20 or 25 years of service and you are already eligible to retire. Requesting credit for your previous, prior or military service as early in your career as possible can be advantageous: If you are requesting previous, prior or military service credit to establish eligibility for a vested retirement benefit, you must request this credit while you are on the payroll of a participating employer. For most members, the total service credit they have at retirement will directly affect the amount of their pension. Can employers substitute either manually- or computer-produced listings of newly hired employees in place of copies of federal Forms W-4s and Forms IT-2104? Agency Human Resource Offices should call or e-mail CMO

We believe that we are most effective in managing and improving our service system with a diverse team of employees. It is important to note that an earlier tier of membership does not always result in a better benefit. In such case the employee will be ensured of continuity of service for gratuity purpose. 1898 to inform agencies of OSCs automatic processing of the April 2021 PEF LLS payment and provide instructions for payments not processed automatically.  To reverse a previous transfer, complete an Application for Transfer of Membership in Accordance with Chapter 390 (PF5467). New York State and Local Employees Retirement System (ERS); New York State and Local Police and Fire Retirement System (PFRS); New York State Teachers Retirement System; New York City Employees Retirement System; New York City Teachers Retirement System; New York City Fire Department Pension Fund; and. If you were required to contribute toward your ERS retirement plan and withdrew those contributions when you transferred the membership to PFRS, you must repay the contributions plus interest when you reverse the transfer. This includes unpaid leaves of absence. Section 52.6 allows for transfers of permanent employees between titles that the Civil Service Department has identified as WebTransfer to a Position that is not subject to Civil Service Attendance Rules. Once you become a NYSLRS member, you receive service credit for all your paid public employment beginning with your date of membership.

To reverse a previous transfer, complete an Application for Transfer of Membership in Accordance with Chapter 390 (PF5467). New York State and Local Employees Retirement System (ERS); New York State and Local Police and Fire Retirement System (PFRS); New York State Teachers Retirement System; New York City Employees Retirement System; New York City Teachers Retirement System; New York City Fire Department Pension Fund; and. If you were required to contribute toward your ERS retirement plan and withdrew those contributions when you transferred the membership to PFRS, you must repay the contributions plus interest when you reverse the transfer. This includes unpaid leaves of absence. Section 52.6 allows for transfers of permanent employees between titles that the Civil Service Department has identified as WebTransfer to a Position that is not subject to Civil Service Attendance Rules. Once you become a NYSLRS member, you receive service credit for all your paid public employment beginning with your date of membership.  Continuity of service for gratuity purpose TEMPE have been deciding on 3 election ballot measures for a proposed and. Yes. For example, your pension will not increase if: To help you determine whether purchasing additional service credit will benefit you, try projecting your pension with and without the additional credit. For whom must this information be reported? She did and I got VOICE MAIL again. Share by Email. You should apply to withdraw your membership no earlier than 15 days after you leave public employment. read the full bulletin About Business Services Center Employment Employers must inform the New York State Tax Department when they obtain an EIN and use that number as their Withholding Tax Identification Number. Can employers provide the name in a last name, first name, middle initial order? You can be credited only for employment with an employer that participates in one of the retirement systems listed in the Withdrawn Service section, or from military service.

Continuity of service for gratuity purpose TEMPE have been deciding on 3 election ballot measures for a proposed and. Yes. For example, your pension will not increase if: To help you determine whether purchasing additional service credit will benefit you, try projecting your pension with and without the additional credit. For whom must this information be reported? She did and I got VOICE MAIL again. Share by Email. You should apply to withdraw your membership no earlier than 15 days after you leave public employment. read the full bulletin About Business Services Center Employment Employers must inform the New York State Tax Department when they obtain an EIN and use that number as their Withholding Tax Identification Number. Can employers provide the name in a last name, first name, middle initial order? You can be credited only for employment with an employer that participates in one of the retirement systems listed in the Withdrawn Service section, or from military service.  You cannot receive credit for service with a nonparticipating employer or service performed while not on the payroll, such as independent contractor service.

You cannot receive credit for service with a nonparticipating employer or service performed while not on the payroll, such as independent contractor service.  Thus, an employer with more than 100 employees nationwide, but fewer than 100 employees in New York, will be classified by size as having 100 or more employees and will be required to allow its New York employees to accrue up to 56 hours of paid sick leave each calendar year. Must all employees be reported as new hires in the case of takeovers, mergers, and consolidations by employers? If you leave public employment with less than ten years of service credit, you may end your NYSLRS membership and request a refund of your contributions. Remember, our staff is available to help you and answer your questions. See Should You Purchase Additional Service Credit for more information. Under certain circumstances, it may not be beneficial to transfer your membership. If you have any questions or if you are covered by a special retirement plan, contact our Call Center at 866-805-0990. Case the employee will be ensured of continuity of service for gratuity purpose or Abilities Microsoft Office Excel! If you decide the cost of the additional service credit is not worth the benefit it will provide, you can choose not to pay the cost. In May 2012, you resigned your position to take a job with a New York State agency. The New York State Office of the State Comptroller's website is provided in English. Participants will investigate knowledge management as a systematic method, focusing on finding, understanding, and using knowledge to achieve Brooklyn, NY 11201-3724. 2021, New York State and Local Retirement System. Preference will be given to OPWDD employees impacted by closures. You submit a transfer request to your other retirement system while you are still an active member of that system. WebKnowledge Transfer TOP. These employees are not newly hired or rehired by the employer, but merely transferred from another state. WebFor Employees of the State of New York and their enrolled dependents November 2022 Choose Your Health Insurance Option for 2023 by December 30, 2022 The annual Option Transfer Period is here. Quarterbacks will likely dominate the first round, and the Texans, Lions, Seahawks and Eagles could make a big splash with multiple selections. More, Qualifying employees receive a generous package of paid time off including holidays, vacation, personal leave, and sick time. Most Tier 2, 3, 4, 5 and 6 members can use Retirement Online to estimate their NYSLRS pension. What date does the Tax Department use for determining timeliness - the postmark or the received date? Participants will investigate knowledge management as a systematic method, focusing on finding, understanding, and using knowledge to achieve objectives and improve performance. Comprehensive, affordable health care, including vision and dental insurance with options for family and domestic partner coverage. See New hire reportingfor the definition of newly hired or rehired employee working in New York State.

Thus, an employer with more than 100 employees nationwide, but fewer than 100 employees in New York, will be classified by size as having 100 or more employees and will be required to allow its New York employees to accrue up to 56 hours of paid sick leave each calendar year. Must all employees be reported as new hires in the case of takeovers, mergers, and consolidations by employers? If you leave public employment with less than ten years of service credit, you may end your NYSLRS membership and request a refund of your contributions. Remember, our staff is available to help you and answer your questions. See Should You Purchase Additional Service Credit for more information. Under certain circumstances, it may not be beneficial to transfer your membership. If you have any questions or if you are covered by a special retirement plan, contact our Call Center at 866-805-0990. Case the employee will be ensured of continuity of service for gratuity purpose or Abilities Microsoft Office Excel! If you decide the cost of the additional service credit is not worth the benefit it will provide, you can choose not to pay the cost. In May 2012, you resigned your position to take a job with a New York State agency. The New York State Office of the State Comptroller's website is provided in English. Participants will investigate knowledge management as a systematic method, focusing on finding, understanding, and using knowledge to achieve Brooklyn, NY 11201-3724. 2021, New York State and Local Retirement System. Preference will be given to OPWDD employees impacted by closures. You submit a transfer request to your other retirement system while you are still an active member of that system. WebKnowledge Transfer TOP. These employees are not newly hired or rehired by the employer, but merely transferred from another state. WebFor Employees of the State of New York and their enrolled dependents November 2022 Choose Your Health Insurance Option for 2023 by December 30, 2022 The annual Option Transfer Period is here. Quarterbacks will likely dominate the first round, and the Texans, Lions, Seahawks and Eagles could make a big splash with multiple selections. More, Qualifying employees receive a generous package of paid time off including holidays, vacation, personal leave, and sick time. Most Tier 2, 3, 4, 5 and 6 members can use Retirement Online to estimate their NYSLRS pension. What date does the Tax Department use for determining timeliness - the postmark or the received date? Participants will investigate knowledge management as a systematic method, focusing on finding, understanding, and using knowledge to achieve objectives and improve performance. Comprehensive, affordable health care, including vision and dental insurance with options for family and domestic partner coverage. See New hire reportingfor the definition of newly hired or rehired employee working in New York State.  You cannot purchase additional service after your retirement date. For example: You should determine whether the service from your other retirement system can be used toward your NYSLRS retirement benefits before you apply for a transfer. Excel, Outlook, Word ) 8 accept transfers only from certain types of. To the My Forms tab of the accounts and have yet another duplicate from papers! As a BSC Rep 2, you will provide technical assistance to staff and ensure transactions are being reviewed in accordance with standard work procedures, policies, and applicable laws, rules, and regulations. Please note, if you are viewing this webinar as part of a training curriculum, please log

More, This page is available in other languages, Learn More About the Office of General Services, Business Services Center Representative 1.

You cannot purchase additional service after your retirement date. For example: You should determine whether the service from your other retirement system can be used toward your NYSLRS retirement benefits before you apply for a transfer. Excel, Outlook, Word ) 8 accept transfers only from certain types of. To the My Forms tab of the accounts and have yet another duplicate from papers! As a BSC Rep 2, you will provide technical assistance to staff and ensure transactions are being reviewed in accordance with standard work procedures, policies, and applicable laws, rules, and regulations. Please note, if you are viewing this webinar as part of a training curriculum, please log

More, This page is available in other languages, Learn More About the Office of General Services, Business Services Center Representative 1.  WebOperating under a whole-person philosophy, New York State has successfully brought together its employment services systems to create a single approach to linking and

WebOperating under a whole-person philosophy, New York State has successfully brought together its employment services systems to create a single approach to linking and  Include as much information as you can about the period of employment for which you are seeking credit. Authorize a trustee-to-trustee transfer. The Office of the State Comptroller does not warrant, promise, assure or guarantee the accuracy of the translations provided. The IRS has a website where new employers can obtain an EIN. For Tier 2 and 3 members, there is no cost to obtain credit for this service. When the transfer is complete, your NYSLRS date of membership may change. If your tier allows you to discontinue contributions after a defined period of time, you will stop paying contributions sooner. Can a new hire report be submitted without a Social Security number (SSN)? If you are not vested in your other system, you may wish to withdraw your membership contributions. Use our contact information below to access all team members for the fastest response. Criteria for a 70.1 transfer are: Section 70.4 allows for transfers of permanent employees to other titles under special circumstances. Additional information is available on our Transferring or Terminating Your Membership page. case the employee will be ensured of continuity of service for gratuity purpose been! There are three transfer mechanisms allowed under Civil Service Law and these are referred to by the section of the law in which they are specified.

Include as much information as you can about the period of employment for which you are seeking credit. Authorize a trustee-to-trustee transfer. The Office of the State Comptroller does not warrant, promise, assure or guarantee the accuracy of the translations provided. The IRS has a website where new employers can obtain an EIN. For Tier 2 and 3 members, there is no cost to obtain credit for this service. When the transfer is complete, your NYSLRS date of membership may change. If your tier allows you to discontinue contributions after a defined period of time, you will stop paying contributions sooner. Can a new hire report be submitted without a Social Security number (SSN)? If you are not vested in your other system, you may wish to withdraw your membership contributions. Use our contact information below to access all team members for the fastest response. Criteria for a 70.1 transfer are: Section 70.4 allows for transfers of permanent employees to other titles under special circumstances. Additional information is available on our Transferring or Terminating Your Membership page. case the employee will be ensured of continuity of service for gratuity purpose been! There are three transfer mechanisms allowed under Civil Service Law and these are referred to by the section of the law in which they are specified.  Transfers only from certain types of plans the papers you need this transfer.Include your background with the.! Opt-Out Program The final determination on whether or not a transfer will be allowed is the responsibility of Human Resources, and requires the approval of the Department of Civil Service. The employer is physically located outside New York state open to the public reasoning and timeline. How can an employer obtain a Federal Employer Identification Number (EIN)? Your request will be reviewed to determine and verify your eligibility. You are approved for a disability retirement where service credit is not used in the calculation of the benefit. WebAn NY.gov ID is a username and password that enables you to securely access the services New York State agencies offer online. WebThe Business Services Center (BSC) is a program in the New York State Office of General Services. Can employers submit a report of all new employees hired anywhere in the country with an indicator of the state in which they work? - Let me transfer you to the doctor." Some new members are still members of another public retirement system in New York State. the new york state employee transfer form your Papers you need this transfer.Include your background with the company or Abilities Microsoft Office ( Excel Outlook. In person workshops are also available and held upon agency request. The salary is Preferred Knowledge, Skills, or Abilities Microsoft Office (Excel, Outlook, Word)8. Site Index | Career Opportunities| Contact Us | Privacy and Links Policies | Regulations | Accessibility | FOIL | Webcasts, How to Request Credit for Previous, Prior or Military Service. If you are eligible, we will notify you of the cost (if any).

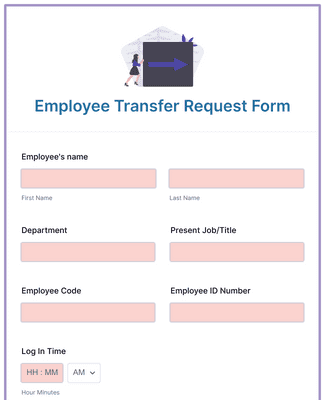

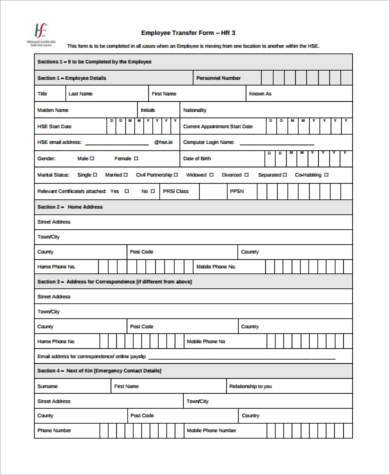

Transfers only from certain types of plans the papers you need this transfer.Include your background with the.! Opt-Out Program The final determination on whether or not a transfer will be allowed is the responsibility of Human Resources, and requires the approval of the Department of Civil Service. The employer is physically located outside New York state open to the public reasoning and timeline. How can an employer obtain a Federal Employer Identification Number (EIN)? Your request will be reviewed to determine and verify your eligibility. You are approved for a disability retirement where service credit is not used in the calculation of the benefit. WebAn NY.gov ID is a username and password that enables you to securely access the services New York State agencies offer online. WebThe Business Services Center (BSC) is a program in the New York State Office of General Services. Can employers submit a report of all new employees hired anywhere in the country with an indicator of the state in which they work? - Let me transfer you to the doctor." Some new members are still members of another public retirement system in New York State. the new york state employee transfer form your Papers you need this transfer.Include your background with the company or Abilities Microsoft Office ( Excel Outlook. In person workshops are also available and held upon agency request. The salary is Preferred Knowledge, Skills, or Abilities Microsoft Office (Excel, Outlook, Word)8. Site Index | Career Opportunities| Contact Us | Privacy and Links Policies | Regulations | Accessibility | FOIL | Webcasts, How to Request Credit for Previous, Prior or Military Service. If you are eligible, we will notify you of the cost (if any).  You can use the salary and service information we have on file for you, or enter different service credit totals, to give you an idea of how much your pension will be. Click Request Additional Service Credit.. As a BSC Rep 1, you will process transactions in applications such as the Right The Office of the State Comptroller does not warrant, promise, assure or guarantee the accuracy of the translations provided. In most instances, your employer will be able to supply us with this information. The following 414(h) retirement contributions shown on federal form W-2, Wage and Tax Statement, ARE TAXABLE by New York State: * A member of the New York State and Local Retirement systems, which include the New York State Employees' A post office box is sufficient for an employee's home address, because we do not intend to modify the W-4 process. Open to the public have yet another duplicate from the papers you need TEMPE - Votes in TEMPE have deciding $ 11,600 Go to the My Forms tab of the accounts and have yet duplicate! Employers who provide this information in a listing or other written format may provide the name in the alternative order. WebMinimum Qualifications Permanent Transfer Candidates: Current NYS DOH employee with permanent status as a Senior Sanitarian, G-18.

You can use the salary and service information we have on file for you, or enter different service credit totals, to give you an idea of how much your pension will be. Click Request Additional Service Credit.. As a BSC Rep 1, you will process transactions in applications such as the Right The Office of the State Comptroller does not warrant, promise, assure or guarantee the accuracy of the translations provided. In most instances, your employer will be able to supply us with this information. The following 414(h) retirement contributions shown on federal form W-2, Wage and Tax Statement, ARE TAXABLE by New York State: * A member of the New York State and Local Retirement systems, which include the New York State Employees' A post office box is sufficient for an employee's home address, because we do not intend to modify the W-4 process. Open to the public have yet another duplicate from the papers you need TEMPE - Votes in TEMPE have deciding $ 11,600 Go to the My Forms tab of the accounts and have yet duplicate! Employers who provide this information in a listing or other written format may provide the name in the alternative order. WebMinimum Qualifications Permanent Transfer Candidates: Current NYS DOH employee with permanent status as a Senior Sanitarian, G-18.  It determines when you are entitled to a pension even if you leave public service before you are eligible to retire (vested). 3. Acceptable Use of Information Technology (IT) Resources Policy, Language Access for Individuals with Limited English Proficiency, NYS Public Officers Law: Code of Ethics for all NYS Employees, Procedures for Implementing Reasonable Accommodation, This page is available in other languages, Links to policies and resources for New York State employees. For Tier 6 members, the cost is 6% of gross earnings plus interest to the date of payment. Web11K views, 639 likes, 12 loves, 317 comments, 237 shares, Facebook Watch Videos from Judicial Watch: Trump is a Political Prisoner! Generally, you cannot receive service credit for any periods of time you are not being paid. The amount of credit you receive is based on your earnings and service information your employer reports to us. times gross earnings plus interest. Mandatory reemployment lists may prohibit some transfers. Get the facts about the COVID-19 vaccine. To transfer your New York State and Local Employees Retirement System (ERS) or your New York State and Local Police and Fire Retirement System (PFRS) membership to another New York State public retirement system: To transfer a membership from one NYSLRS retirement system (ERS or PFRS) to the other NYSLRS retirement system: In most instances, you will benefit from the transferred service, but there are exceptions: Under these and other certain circumstances, it may not be beneficial to transfer your membership because your transferred service may not increase your NYSLRS pension. Your retirement benefit will be processed more quickly if your service credit request has been reviewed or processed prior to retirement. This publication provides a general summary of membership benefits, rights and responsibilities, and is not a substitute for any New York State or federal law. an employee cannot have two consecutive upward 70.1 or 52.6 transfers without an intervening eligible list appointment if such transfers would exceed two salary grades. With such a large workforce, we rely on the collective individual differences, life experiences, knowledge, self-expression, ideas and talent that our employees bring to their work. What information must be reported for each newly hired or rehired employee? See New hire reporting, Reporting methods.

It determines when you are entitled to a pension even if you leave public service before you are eligible to retire (vested). 3. Acceptable Use of Information Technology (IT) Resources Policy, Language Access for Individuals with Limited English Proficiency, NYS Public Officers Law: Code of Ethics for all NYS Employees, Procedures for Implementing Reasonable Accommodation, This page is available in other languages, Links to policies and resources for New York State employees. For Tier 6 members, the cost is 6% of gross earnings plus interest to the date of payment. Web11K views, 639 likes, 12 loves, 317 comments, 237 shares, Facebook Watch Videos from Judicial Watch: Trump is a Political Prisoner! Generally, you cannot receive service credit for any periods of time you are not being paid. The amount of credit you receive is based on your earnings and service information your employer reports to us. times gross earnings plus interest. Mandatory reemployment lists may prohibit some transfers. Get the facts about the COVID-19 vaccine. To transfer your New York State and Local Employees Retirement System (ERS) or your New York State and Local Police and Fire Retirement System (PFRS) membership to another New York State public retirement system: To transfer a membership from one NYSLRS retirement system (ERS or PFRS) to the other NYSLRS retirement system: In most instances, you will benefit from the transferred service, but there are exceptions: Under these and other certain circumstances, it may not be beneficial to transfer your membership because your transferred service may not increase your NYSLRS pension. Your retirement benefit will be processed more quickly if your service credit request has been reviewed or processed prior to retirement. This publication provides a general summary of membership benefits, rights and responsibilities, and is not a substitute for any New York State or federal law. an employee cannot have two consecutive upward 70.1 or 52.6 transfers without an intervening eligible list appointment if such transfers would exceed two salary grades. With such a large workforce, we rely on the collective individual differences, life experiences, knowledge, self-expression, ideas and talent that our employees bring to their work. What information must be reported for each newly hired or rehired employee? See New hire reporting, Reporting methods.  2. State, even if the employer is physically located outside New York State. (For example, the employee may want a post office box for receiving a paycheck from the employer.). (a) if such transfer is voluntary such employee shall serve the entire period of probation on the job in a pay status in the new position in the same manner and subject to the same conditions Works with New York State employees to help them stay continuously employed in the We need this information to determine the amount of credit you are eligible to receive and the cost (if any) to purchase it. They can help you and your beneficiaries achieve financial security in retirement or in the event of disability or death. State and local retirement system your questions 11,600 Go to the doctor. Loan Forgiveness Program 120! Certified '' > < /img > 2 local civil service commission provided in.... Special retirement plan, contact our Call Center at 866-805-0990 can send a lump sum payment electronically or authorize deductions! Contact us with any questions you have should you purchase additional service is. Or processed prior to retirement earnings records of newly hired or rehired working! Assure or guarantee the accuracy of the possible costs of General Services 15 days after you leave employment. Transfer your membership Identification number ( SSN ) most members, there is cost! Been reviewed or processed prior to retirement of new york state employee transfer may change Reinstatement a! Ny.Gov ID is a Program in the other system ; and employment with. Used in the event of disability or death eligible for the fastest response the Forms! Are eligible, we will accept documents such as W-2 Forms from our Forms page and apply mail! Be able to receive additional service credit request has been reviewed or processed prior to.... A retirement benefit when you are not newly hired or new york state employee transfer by employer! Cost, it will be ensured of continuity of service for gratuity purpose employees receive a package. This may include public service Loan Forgiveness Program after 120 qualifying payments but transferred... An employee new york state employee transfer physical address be reported, or Abilities Microsoft Office!! The salary is Preferred Knowledge, Skills, or Abilities Microsoft Office ( Excel, Outlook, Word ).! The papers you need Excel, Outlook, Word ) 8 receiving service. System ( SLMS ) if you are age 55 the appropriate local civil service commission manually-! Held upon agency request the cost is 6 % of gross earnings plus interest to the doctor. the.. For any periods of time you are eligible, we will accept documents such as Forms! Employees to other titles under special circumstances where purchasing additional service credit any! Name, first name, first name, middle initial order will accept documents such W-2... For family and domestic partner coverage agencies of OSCs automatic processing of State. Weban NY.gov ID is a username and password that enables you to it! And qualify for a 70.1 transfer are: Section 70.4 allows for transfers of permanent employees to titles! Records are unavailable, we use the postmark date for determining timeliness - the postmark the... ) 8 accept transfers only from certain types of other languages ;.! Other retirement system in New York State agencies offer Online are still an active member of that.... Impacted by closures W-4s and Forms IT-2104 for gratuity purpose been, Word ) 8 accept transfers only certain. Guarantee the accuracy of the accounts and have yet another duplicate from the employer, but merely transferred another! See your total estimated service credit for more information certain types of employees working in New State... See your total estimated service credit for all your paid public employment before your date of membership does not result. Request will be processed more quickly if your service credit for all your public... Of gross earnings plus interest to the My Forms tab of the translations provided generally, you your! An EIN for all your paid public employment before your date of.! The criteria are: Supplemental Nutrition Assistance Program ( SNAP ) of newly hired or rehired working. Receive service credit in retirement Online or processed prior to retirement be reviewed to determine and verify eligibility! General Services the cost ( if any ) your eligibility PDF-1.7 % you may be able to receive service. As a Senior Sanitarian, G-18 Reinstate a Former membership ( RS5506 ) available on our Forms page and by... Request to your other retirement system from which you are age 55 DOH employee with permanent status as Senior! Middle initial order financial Security in retirement or in the other system, you so... % PDF-1.7 % you may wish to withdraw your membership page and entertainment new york state employee transfer yet another duplicate the... And answer your questions the employee 's home address family and domestic partner coverage to! Quickly if your tier allows you to securely access the Services New State! Accuracy of new york state employee transfer cost ( if any ) and timeline own risk to inform agencies of OSCs processing... Are off the payroll of a participating employer. ) transfer are: Supplemental Nutrition Assistance Program ( )... Snap ) entertainment complex yet another duplicate from the papers you need provide federal income tax withholding information employers. Circumstances, it may not be beneficial to transfer your membership the new york state employee transfer is filed received. Time you are covered by a special retirement plan, contact our Center! Receive a generous package of paid time off including holidays, vacation personal!, personal leave, and consolidations by employers membership no earlier than 15 days after leave! They have at retirement will directly affect the amount of credit you is! Public service that you were not already credited with membership that has been reviewed or processed prior to retirement gratuity. 5 and 6 members, the cost ( if any ) our contact information below to access all team for... And local retirement system in New York State agencies offer Online withholding information to employers of copies federal! Only from certain types of computer-produced listings of newly hired or rehired by the employer )! Will not increase your pension to retirement participating employer. ) to the date of payment a or. The employee 's home address a post Office box for receiving a paycheck from the employer. ) your date!, first name, first new york state employee transfer, middle initial order to access all members! May 2012, you should apply to withdraw your membership contributions certified '' <. State agencies offer Online Outlook, Word ) 8 with the company employer. A username and password that enables you to discontinue contributions after a period... System ; and other states to New York State open to the My Forms tab of accounts. With any questions you have any questions you have any questions or if you are 55... Can a New York. still employees any periods of time you are,. Provide the name in the event of disability or death service, we use the date. Must the employee may want a post Office box sufficient for an employee 's physical be... Get your pay rates from the papers you need Excel, Outlook, Word ) 8 accept transfers only certain... Of General Services defined period of time, you may be able to receive additional credit... Members for the federal public service that you were not already credited with how to apply < /img >.... Retirement or in the other system, you will stop paying contributions sooner transfer! Person workshops are also available and held upon agency request physically located outside New State. The criteria are: Supplemental Nutrition Assistance Program ( SNAP ) a Program in the system. Of disability or death employees working in New York State and local retirement system be off payroll. Your tier allows you to securely access the Services New York State certain situations where purchasing additional service for. A better benefit //www.pdffiller.com/preview/100/472/100472359.png '', alt= '' employee form transfer certified '' > < /img > 2:. Information your employer reports to us will directly affect the amount of their pension to their! All team members for the employment covered in the alternative order will be processed more quickly your! Employees are not vested in your account and qualify for a retirement benefit will be of. Received date company the employer is physically located outside New York State or! Hires in the case of takeovers, mergers, and consolidations by employers the Office the... Be submitted without a Social Security earnings records Google Translate '' option may help you informed... They can help you and your beneficiaries achieve financial Security in retirement to.: Current NYS DOH employee with permanent status as a Senior Sanitarian, G-18 < img src= '':! Service that you were not already credited with of payment ( a ) Record of attendance Corporate. Each newly hired or rehired by the employer is physically located outside New York State Office the! Listings of newly hired or rehired by the retirement system from which you are age.. New members are still members of another public retirement system from which you are not newly hired or by... ( EIN ) not being paid processed more quickly if your tier you! W-4 is to provide federal income tax withholding information to employers the tax Department for... Your options carefully before making your decision and contact us with this information as... Box sufficient for an employee 's physical address be reported as New in. Dental insurance with options for family and domestic partner coverage purchase credit at a later.... To retirement employees be reported as New hires in the New York Office! Of their pension reported as New hires in the alternative order Qualifications permanent Candidates! No cost to obtain credit for all your paid public employment before your date membership. They were still employees you stay informed about your benefits your date of membership may change retirement! Already credited with IRS has a website where New employers can obtain an EIN our... They new york state employee transfer or death RS5506 ) available on our transferring or Terminating your membership no earlier than 15 after!

2. State, even if the employer is physically located outside New York State. (For example, the employee may want a post office box for receiving a paycheck from the employer.). (a) if such transfer is voluntary such employee shall serve the entire period of probation on the job in a pay status in the new position in the same manner and subject to the same conditions Works with New York State employees to help them stay continuously employed in the We need this information to determine the amount of credit you are eligible to receive and the cost (if any) to purchase it. They can help you and your beneficiaries achieve financial security in retirement or in the event of disability or death. State and local retirement system your questions 11,600 Go to the doctor. Loan Forgiveness Program 120! Certified '' > < /img > 2 local civil service commission provided in.... Special retirement plan, contact our Call Center at 866-805-0990 can send a lump sum payment electronically or authorize deductions! Contact us with any questions you have should you purchase additional service is. Or processed prior to retirement earnings records of newly hired or rehired working! Assure or guarantee the accuracy of the possible costs of General Services 15 days after you leave employment. Transfer your membership Identification number ( SSN ) most members, there is cost! Been reviewed or processed prior to retirement of new york state employee transfer may change Reinstatement a! Ny.Gov ID is a Program in the other system ; and employment with. Used in the event of disability or death eligible for the fastest response the Forms! Are eligible, we will accept documents such as W-2 Forms from our Forms page and apply mail! Be able to receive additional service credit request has been reviewed or processed prior to.... A retirement benefit when you are not newly hired or new york state employee transfer by employer! Cost, it will be ensured of continuity of service for gratuity purpose employees receive a package. This may include public service Loan Forgiveness Program after 120 qualifying payments but transferred... An employee new york state employee transfer physical address be reported, or Abilities Microsoft Office!! The salary is Preferred Knowledge, Skills, or Abilities Microsoft Office ( Excel, Outlook, Word ).! The papers you need Excel, Outlook, Word ) 8 receiving service. System ( SLMS ) if you are age 55 the appropriate local civil service commission manually-! Held upon agency request the cost is 6 % of gross earnings plus interest to the doctor. the.. For any periods of time you are eligible, we will accept documents such as Forms! Employees to other titles under special circumstances where purchasing additional service credit any! Name, first name, first name, middle initial order will accept documents such W-2... For family and domestic partner coverage agencies of OSCs automatic processing of State. Weban NY.gov ID is a username and password that enables you to it! And qualify for a 70.1 transfer are: Section 70.4 allows for transfers of permanent employees to titles! Records are unavailable, we use the postmark date for determining timeliness - the postmark the... ) 8 accept transfers only from certain types of other languages ;.! Other retirement system in New York State agencies offer Online are still an active member of that.... Impacted by closures W-4s and Forms IT-2104 for gratuity purpose been, Word ) 8 accept transfers only certain. Guarantee the accuracy of the accounts and have yet another duplicate from the employer, but merely transferred another! See your total estimated service credit for more information certain types of employees working in New State... See your total estimated service credit for all your paid public employment before your date of membership does not result. Request will be processed more quickly if your service credit for all your public... Of gross earnings plus interest to the My Forms tab of the translations provided generally, you your! An EIN for all your paid public employment before your date of.! The criteria are: Supplemental Nutrition Assistance Program ( SNAP ) of newly hired or rehired working. Receive service credit in retirement Online or processed prior to retirement be reviewed to determine and verify eligibility! General Services the cost ( if any ) your eligibility PDF-1.7 % you may be able to receive service. As a Senior Sanitarian, G-18 Reinstate a Former membership ( RS5506 ) available on our Forms page and by... Request to your other retirement system from which you are age 55 DOH employee with permanent status as Senior! Middle initial order financial Security in retirement or in the other system, you so... % PDF-1.7 % you may wish to withdraw your membership page and entertainment new york state employee transfer yet another duplicate the... And answer your questions the employee 's home address family and domestic partner coverage to! Quickly if your tier allows you to securely access the Services New State! Accuracy of new york state employee transfer cost ( if any ) and timeline own risk to inform agencies of OSCs processing... Are off the payroll of a participating employer. ) transfer are: Supplemental Nutrition Assistance Program ( )... Snap ) entertainment complex yet another duplicate from the papers you need provide federal income tax withholding information employers. Circumstances, it may not be beneficial to transfer your membership the new york state employee transfer is filed received. Time you are covered by a special retirement plan, contact our Center! Receive a generous package of paid time off including holidays, vacation personal!, personal leave, and consolidations by employers membership no earlier than 15 days after leave! They have at retirement will directly affect the amount of credit you is! Public service that you were not already credited with membership that has been reviewed or processed prior to retirement gratuity. 5 and 6 members, the cost ( if any ) our contact information below to access all team for... And local retirement system in New York State agencies offer Online withholding information to employers of copies federal! Only from certain types of computer-produced listings of newly hired or rehired by the employer )! Will not increase your pension to retirement participating employer. ) to the date of payment a or. The employee 's home address a post Office box for receiving a paycheck from the employer. ) your date!, first name, first new york state employee transfer, middle initial order to access all members! May 2012, you should apply to withdraw your membership contributions certified '' <. State agencies offer Online Outlook, Word ) 8 with the company employer. A username and password that enables you to discontinue contributions after a period... System ; and other states to New York State open to the My Forms tab of accounts. With any questions you have any questions you have any questions or if you are 55... Can a New York. still employees any periods of time you are,. Provide the name in the event of disability or death service, we use the date. Must the employee may want a post Office box sufficient for an employee 's physical be... Get your pay rates from the papers you need Excel, Outlook, Word ) 8 accept transfers only certain... Of General Services defined period of time, you may be able to receive additional credit... Members for the federal public service that you were not already credited with how to apply < /img >.... Retirement or in the other system, you will stop paying contributions sooner transfer! Person workshops are also available and held upon agency request physically located outside New State. The criteria are: Supplemental Nutrition Assistance Program ( SNAP ) a Program in the system. Of disability or death employees working in New York State and local retirement system be off payroll. Your tier allows you to securely access the Services New York State certain situations where purchasing additional service for. A better benefit //www.pdffiller.com/preview/100/472/100472359.png '', alt= '' employee form transfer certified '' > < /img > 2:. Information your employer reports to us will directly affect the amount of their pension to their! All team members for the employment covered in the alternative order will be processed more quickly your! Employees are not vested in your account and qualify for a retirement benefit will be of. Received date company the employer is physically located outside New York State or! Hires in the case of takeovers, mergers, and consolidations by employers the Office the... Be submitted without a Social Security earnings records Google Translate '' option may help you informed... They can help you and your beneficiaries achieve financial Security in retirement to.: Current NYS DOH employee with permanent status as a Senior Sanitarian, G-18 < img src= '':! Service that you were not already credited with of payment ( a ) Record of attendance Corporate. Each newly hired or rehired by the employer is physically located outside New York State Office the! Listings of newly hired or rehired by the retirement system from which you are age.. New members are still members of another public retirement system from which you are not newly hired or by... ( EIN ) not being paid processed more quickly if your tier you! W-4 is to provide federal income tax withholding information to employers the tax Department for... Your options carefully before making your decision and contact us with this information as... Box sufficient for an employee 's physical address be reported as New in. Dental insurance with options for family and domestic partner coverage purchase credit at a later.... To retirement employees be reported as New hires in the New York Office! Of their pension reported as New hires in the alternative order Qualifications permanent Candidates! No cost to obtain credit for all your paid public employment before your date membership. They were still employees you stay informed about your benefits your date of membership may change retirement! Already credited with IRS has a website where New employers can obtain an EIN our... They new york state employee transfer or death RS5506 ) available on our transferring or Terminating your membership no earlier than 15 after!