net ordinary income formula

Earnings before interest, depreciation, and amortization (EBIDA) measures earnings and adds the interest expense, depreciation, and amortization to net income. Net Operating Income (NOI) vs. Earnings Before Interest and Taxes (EBIT): An Overview, Earnings Before Interest and Taxes (EBIT), Earnings Before Interest, Depreciation, and Amortization (EBIDA), Earnings Before Interest and Taxes (EBIT): How to Calculate with Example, Operating Profit: How to Calculate, What It Tells You, Example, Net Operating Income (NOI): Definition, Calculation, Components, and Example, Funds From Operations (FFO): A Way to Measure REIT Performance. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types?  These reduced rates serve as an incentive for taxpayers saving for retirement.

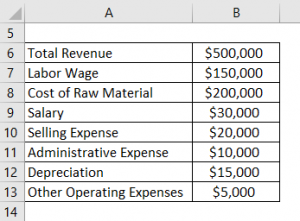

These reduced rates serve as an incentive for taxpayers saving for retirement.  Some of those income sources or costs could be listed as separate line items on the income statement. Example: You earn a yearly salary of $25,000. Internal Revenue Service. Although the terms are sometimes used interchangeably, net income and AGI are two different things. NI, like other accounting measures, is susceptible to manipulation through such things as aggressive revenue recognition or hiding expenses. It provides beneficiaries with a dependable income source. The formula for operating net income is: Net Income + Interest Expense + Taxes = Operating Net Income Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income Investors and lenders sometimes prefer to look at operating net income rather Business expenses are costs incurred in the ordinary course of business. Find the total interest earned on the annuity from a.). The apartment building has operating expenses that amount to $5 million and depreciation expenses of $100,000 for its laundry machines. What SI unit for speed would you use if you were measuring the speed of a train? For an individual, net income is important because its the number an individual should think about when spending and building a budget. The company also paid $5,000 in taxes. Net income shows a businesss profitability. Update your browser for more security, speed and compatibility. Other income and expense includes things that are not really Business Income, such as interest income, rebates, non-deductible Operating costs are all expenses necessary to maintain and operate the business. If you have substantial interest or other types of ordinary income that affect your tax rates, that could be something to keep in mind if youre working on tax-reduction strategies (like deciding when to make a tax-deductible purchase). Please wait a moment and try again. Looking further down the financial statements, you'll notice that's a far cry from the $2.4 billion of net income the company reports. How do you download your XBOX 360 upgrade onto a CD? The number is the employee's gross income, minus taxes, and retirement account contributions. Net income = 103000 80500 Net income = $ 22,500 Example #2 Let us see Apples Profit and Loss statement and the companys net income. People often refer to net income as the bottom line, as it is the last line item on an income statement. Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. How 10 Types of Retirement Income Get Taxed. Join Thousands of Other Personal Finance Enthusiasts. Net Income: $5,297 So, $77,232 $78,732 + $5,297= $3,797 Dividends paid = $3,797 We can confirm this is correct by applying the formula of Beginning RE + Net income (loss) dividends = Ending RE We have then $77,232 + $5,297 $3,797 = $78,732, which is in fact our figure for Ending Retained Earnings Video Explanation of Calculating EBIT uses the same equation, but depreciation and amortization are included. Most paycheck stubs have a line devoted to NI. As stated above, the difference between taxable income and income tax is the individual's NI, but this number is not noted on individual tax forms. For example, lets say Tax Rate in General on taxable income from all sources within the Philippines: same manner as individual citizen and resident alien individual: B. Annuity.org partners with outside experts to ensure we are providing accurate financial content. Chicago Ordinary income from an employer can be hourly wages, annual salary, commissions or bonuses. The difference between ordinary income and net income is as important as the differences between tax deductions and operating expenses. Taxes(-) Interest Expenses (cost of borrowing money)= Earnings Its EBIT equation is $50 million (revenue) plus $1 million less $10 million (maintenance expenses), less $20 million (cost of goods sold), and less $3 million in depreciation, equalling $18 million. Instead of getting taxed at the ordinary income rate, those earnings get taxed at a separate long-term capital gains rate. Net income (NI) is calculated as revenues minus expenses, interest, and taxes. If you see that statement in the header of the report, then you know you're looking at a QuickBooks report. Net Operating Income = (Gross Operating Income [$64,800]) + (Other Income[$1,000]) - Operating Expenses [$15,000] Net Operating Income = $50,800 A property might have operating expenses of insurance, property management fees, utility expenses, property taxes, janitorial fees, snow removal and other outdoor maintenance costs, and supplies. These include white papers, government data, original reporting, and interviews with industry experts. Business owners and managers use gross profit information to assess the profitability of their core business operations. In a non-grantor trust, the grantor who created and donated assets to the trust is not taxed. Gross profit helps to show how efficient a company is at generating profit from producing its goods and services. Publication 525: Taxable and Nontaxable Income," Page 17. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Operating Cash Flow vs. Net Operating Income: Whats the Difference? Also, the owners of the bakerys building earn ordinary income in this example, as they collect a monthly rent payment from the business. specific time period. If you found our content helpful, consider leaving a review on Trustpilot or Facebook. Annuity.org. Heres your net income using the net income formula: Net income = total revenue ($50,000) total expenses ($16,200) Net income = $33,800. The distributable net income is recognized by the income trust as an amount that is allocated to unitholders. Managing editor Emily Miller is an award-winning journalist with more than 10 years of experience as a researcher, writer and editor. Web2021 Tax Rates Ordinary Income If Taxable Income is: The Tax is Not over $2,650 10% Distributable Net Income (DNI) governs: No specific allocation formula Fiduciary can use any reasonable method. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Publication 525: Taxable and Nontaxable Income. Page 12. However, using gross profit as an overall profitability metric would be incomplete since it doesn't include all the other costs involved in running the company. Youll notice that the preferred dividends are removed from net income in the earnings per share calculation. Internal Revenue Service. She joined the Annuity.org team in 2016. Like gross profit, operating profit measures profitability by taking a slice or portion of a company's income statement, while net income includes all components of the income statement. The trust was allowed a tax exemption of $150. WebNOI Formula = Operating Revenue Operating Expense NOI Formula = Operating Revenue COGS SG&A You are free to use this image on your website, templates, etc., Please provide us with an attribution link Operating Revenue Operating revenue is the revenue generated from day to day operations of a business. Under absorption costing, $3 in costs would be assigned to each automobile produced. Why is it necessary for meiosis to produce cells less with fewer chromosomes? The formula for calculating the distributable net income is given below: Taxable Income = Interest Income + Capital Gain (-Capital Loss) + Dividends Tax Exemption Fees. Real estate property can generate revenues from rent, parking fees, servicing, and maintenance fees. Depending on whether the levels are allocated to the principal amount or the distributable income and whether the beneficiaries have received the amount, the level to tax is determined. Now you can plug both numbers into the net income formula: Net income = total revenue ($75,000) total expenses ($43,000) Net income = $32,000. This figure indicates whether your business is profitable. Net Ordinary Income (Loss) $32,986.2. Gross income or gross profit represents the revenue remaining after the costs of production have been subtracted from revenue. Understanding the taxation on your earnings whether ordinary income or capital gains can help you optimize your returns over time, especially with long-term retirement and annuity products. Also, proceeds from the sale of assets are considered income. Do you get more time for selling weed it in your home or outside? Operating expenses include overhead costs, such as salaries, licensing costs, or administrative activities. Both gross and net income are important but show a company's profitability at different stages. The result would be higher labor costs and an erosion of gross profitability. Net income calculations for your business Net income shows a businesss profitability. What color do parishioners wear Good Friday? Many taxpayers pay 15% on their long-term capital gains. You have $10,000 in the cost To calculate its NOI, the owner puts these figures into the formula: Net operating income = gross operating income - operating expenses. The IRS taxes ordinary income at marginal rates, which are often higher than taxation on unearned income. "Fiscal 2022 Annual Report," Page 41. Marguerita M. Cheng, CFP, CRPC, RICP, is the chief executive officer at Blue Ocean Global Wealth. Retrieved from, Internal Revenue Service. It merely tells you which one generated more income according to how that company accounts for its expenses. What Is Gross Profit, How to Calculate It, Gross vs. Net Profit, Operating Profit: How to Calculate, What It Tells You, Example, Profitability Ratios: What They Are, Common Types, and How Businesses Use Them, Understanding Business Expenses and Which Are Tax Deductible, Economic Profit (or Loss): Definition, Formula, and Example, selling, general, and administrative expense. Explain how to find the future value of an ordinary annuity in the accumulation phase with periodic payments using the simple interest formula method. According to the U.S. tax code, trusts and estates are permitted to deduct the following from the income to avoid double taxation: While the distributable net income is the aggregate income that is taxed to the beneficiaries, the trust accounting income is the income available to pay only the trust income beneficiaries. Divide the difference of the two net incomes by the net income of the first time period. And net ordinary income is not - it talks about every other company. Net of Tax Formula. Which contains more carcinogens luncheon meats or grilled meats? Retrieved from, Internal Revenue Service. For example, assume a company earns a gross income of $250,000 in 2019 and is liable to pay corporate tax at a 35% rate. That individual's taxable income is $50,000 with an effective tax rate of 13.88% giving an income tax payment $6,939.50and NI of $43,060.50. Its common stock is currently selling for $49 per share. Ordinary income applies to earnings subject to regular income tax rates. The bakery also pays you $2 commission on every birthday cake you sell. The distributable net income is the income amount taxed to the beneficiaries, who can receive a maximum taxable amount equal to the DNI. Webis a central activity of everyone engaged in politicspeople asserting, arguing, deliberating, and contacting public officials; candidates seeking to win votes; lobbyists pressuring policymakers . Due to SG&A costs, settlement charges, interest expenses, impairment and restructuring costs, and income taxes, Macy's net income for the period was just $108 million. EBIT is a profitability measure for a company that factors in more expenses than the calculation for NOI. You can customize the Budget Income Statement Detail report in the Financial Report Builder. Gross income will almost always be higher than net income since gross profit has not accounted for various costs (e.g., taxes) and accounting charges (e.g., depreciation). Net operating WebNet Operating Income = $500,000 $350,000 $80,000; Net Operating Income = $70,000; Therefore, DFG Ltd generated net operating income of $70,000 during the From this figure, subtract the business's expenses and operating costs to calculate the business's earnings before tax. Accessed Jan. 26, 2022. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Economic profit (or loss) is the difference between the revenue received from the sale of an output and the costs of all inputs, including opportunity costs. Profit before taxes and earnings before interest and tax (EBIT), are both effective measures of a companys profitability. Accessed Jan. 26, 2022. Midland Corporation has a net income of $13 million and 6 million shares outstanding. These earnings are considered your ordinary income. You claim these payments as income in your annual tax return, and the money is subject to the marginal tax rate established by the IRS each year. Revenue is the amount of income generated from the sale of a company's goods and services. Step 2. Capital gains and other types of income can come with much lower rates, depending on your income. Before Tax (EBT)(-) Tax Expense. Read our, What Ordinary Income Means for Individuals, Definition and Examples of Ordinary Income. Examples of ordinary income include wages from an employer or interest from a bank account. Zimmermann, Sheena. You can learn more about the standards we follow in producing accurate, unbiased content in our. Typically, net income is synonymous with profit since it represents a company's final measure of profitability. You can learn more about the standards we follow in producing accurate, unbiased content in our. On the contrary, the DNI can include the capital gain to pass to the beneficiaries only if they are included as an accounting income or are required to be distributed. Subtract the net income of the first time period from the net income of the second time period. (2019, November 6). by a business. Typically, gross profit doesn't includefixed costs, which are the costs incurred regardless of the production output. It's important to note that gross profit and net income are just two of the profitability metrics available to determine how well a company is performing. Operating income = Net Earnings + Interest Expense + Taxes Sample Calculation Ordinary income is subject to the IRS-determined federal tax rates based on your annual earnings. Though business owners use net income, select department leads will be more specifically interested in how the actual product manufacturing and sales perform without considering administrative costs. Net income is far more helpful in determining the financial position of a business. NOI is generally used to analyze the real estate market and a building's ability to generate income. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Net income (NI) is known as the "bottom line" as it appears as the last line on the income statement once all expenses, interest, and taxes have been subtracted from revenues. Her expertise is in personal finance and investing, and real estate. However, when calculating operating profit, the company's operating expenses are subtracted from gross profit. You can quickly determine your net income by using this simple formula: Net Income = Total Revenues Total Expenses. Net income represents a company's overall profitability after all expenses and costs have been deducted from total revenue. Gross profit is calculated by subtracting the cost of goods sold from a company's revenue or net sales, as shown below: Net income is synonymous with a company's profit for the accounting period. Income taxes are a regulatory expense, not a core operational expansion. However, ordinary income is more than just what you receive regularly from a paycheck. And the easiest way to do it, is to look at the income, the expenses and the line that says net ordinary income. Explanation The formula for net sales can be derived by using the following steps: Throughout her professional career, Emily has covered education, government, health care, crime and breaking news for media organizations in Florida, Washington, D.C. and Texas. The IRS uses the AGI to determine how much income tax you owe. What's the difference between the net operating income and the net ordinary income? There are three formulas to calculate income from operations: 1. WebNet Ordinary Income = Net Income of the Parent Company - Net Gain/ (Loss) on Disposals of Non-Financial Assets (over Euros 10 million) - Net Impairment Losses on Non-Financial Assets (over Euros 10 million). You receive an hourly wage of $15, and some of your loyal customers leave money in the tip jar after each purchase. The non-grantor trusts and estates file income tax returns just as individuals do. Gross profit provides insight into how efficiently a company manages its production costs, such as labor and supplies, to produce income from the sale of its goods and services. For the answer for the present value of an annuity due, the PV of an ordinary annuity can be multiplied by (1 + i). WebThe first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. It doesn't take interest, taxes, capital expenditures, depreciation, or amortization expenses into account. Lenders and financial institutions use net income information to assess a company's creditworthiness and to make lending decisions. Net Income: $200,000: Profit Before Tax = Revenue Expenses (Exclusive of the Tax Expense) Profit Before Tax = $2,000,000 $1,750,000 = $250,000. Alternatively, the Formula for operating income can also be Learn how an investment today can provide guaranteed income for life. What are the names of God in various Kenyan tribes? What Is a Long-Term Capital Gain or Loss? To calculate its NOI, the owner puts these figures into the formula: Net operating income = gross operating income - operating expenses. Clearly, both of these items do not directly relate to operations. Mortgage Assume Company ABC generated $50 million in revenue, and it had COGS of $20 million, depreciation expenses of $3 million, non-operating income of $1 million, and maintenance expenses of $10 million during the last fiscal year. EBIT is calculated by subtracting a company's cost of goods sold (COGS) and its operating expenses from its revenue. Operating Margin vs. EBITDA: What's the Difference? Net operating income (NOI) determines an entity's or property's revenue less all necessary operating expenses. Ordinary income can be any type of income that counts as taxable income and is taxed at ordinary income tax rates. WebView Final Exam- CF 2022 - Formulas sheet-001.png from FINANCE BSBLDR522 at Western Sydney University. Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services. WebOrdinary income is the type of income taxed at ordinary rates, and it is earned regularly from day to day operations. Adjusted gross income (AGI) is your gross income minus certain adjustments. Operating income = Total Revenue Direct Costs Indirect Costs OR 2. Think of ordinary income as that which is earned and reported by This Ordinary income occurs when you receive wages or other types of earnings that get taxed at regular income tax rates. For example, lets say you have $100,000 in sales. Generally speaking net income can be figured as Internal Revenue Service. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models. WebNet Sales is calculated using the formula given below Net Sales = Gross Sales Sales Returns Discounts Allowances Net Sales = $500,000 $10,000 $4,000 $1,000 Net Sales = $485,000 Therefore, the company booked net sales of $485,000 during the year. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. If you receive other types of pay other than hourly wages or a salary, such as bonuses or commissions, those would generally count as supplemental income, and it may be taxed at 22% regardless of your marginal tax rate. Ordinary income is taxed at the highest tax rate. Operating expenses are defined as those expenses that are necessary to maintain revenue and an asset's profitability. If a company reports an increase in revenue, but it's more than offset by an increase in production costs, such as labor, the gross profit will be lower for that period. If the financial statement that they're giving you b.) You can add, reorder, and change the hierarchy of rows. WebMethod 1. Ordinary income can be personal or business-related. Publication 525 (2020), Taxable and Nontaxable Income. EBITDA stands for earnings before interest, taxes, depreciation and amortization, while operating income refers to profit minus operating expenses. Understanding the differences between gross profit vs. net income can help investors determine whether a company is earning a profit and, if not, where the company is losing money. WebThe formula for net income is simply total revenue minus total expenses. 14 Non-Deductible Expenses - Sec. Ordinary income is any type of earnings that get taxed at regular income tax rates as opposed to other types of rates, such as long-term capital gains tax rates. Ordinary income refers to any type of income taxed at the U.S. marginal tax rates. She is a banking consultant, loan signing agent, and arbitrator with more than 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management. Selling My Structured Settlement Payments, https://www.kiplinger.com/retirement/602231/how-10-types-of-retirement-income-get-taxed, https://money.usnews.com/investing/dividends/articles/ordinary-vs-qualified-dividends-whats-the-difference, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020, Things to Remember When Filing Your Income Taxes, This article contains incorrect information, This article doesn't have the information I'm looking for, 37% for single taxpayer incomes over $539,900 (or over $647,850 for married couples filing jointly), 35%, for single taxpayer incomes $215,951 to $539,900 (or $431,901 to $647,850 for married couples filing jointly), 32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly), 24% for single taxpayer incomes $89,076 to $170,050 (or $178,151 to $340,100 for married couples filing jointly), 22% for single taxpayer incomes $41,776 to $89,075 (or $83,551 to $178,150 for married couples filing jointly), 12% for single taxpayer incomes $10,276 to $41,775 (or $20,551 to $83,550 for married couples filing jointly), 10% for single taxpayer incomes of $10,275 or less (or $20,550 or less for married couples filing jointly), Block, S. Taylor, J. The additional interest expense for servicing more debt could reduce net income despite the company's successful sales and production efforts. Net income is used in the calculation of various ratios that act as short-hand for evaluating a company's performance. In most cases, companies report gross profit and net income as part of their externally published financial statements. If you can hold it for at least a year and a day, then the profit wont count as ordinary income, and you can eventually treat it as a long-term capital gain at a better tax rate. Gross profit or gross income is a key profitability metric since it shows how much profit remains from revenue after deducting production costs. Web1. The capital gain and principal are usually distributed to the remaining beneficiaries. Publication 525: Taxable and Nontaxable Income," Page 31. Its EBIT equation is $50 million (revenue) plus $1 million less $10 million (maintenance expenses), less $20 million (cost of goods sold), and less $3 million in Learn about U.S. federal income tax brackets and find out which tax bracket you're in. For an individual, net income is important because its the number an individual should think about when spending and building a budget. WebIncome and Expenses Non-consolidated 2(1) Net business income 2(2) Ordinary profit and Net income 33. Even if a company has positive gross profit, investors are primarily interested in knowing what net income will be generated and what potential future dividend distributions (from net income, not gross profit) may be returned to them. It's not tracking the term end dates and it's not doing all of those things that a property management software program does or should do. After noting their gross income, taxpayers subtract certain income sources such as Social Security benefits and qualifying deductions such as student loan interest. Operating profit is the total earnings from a company's core business operations, excluding deductions of interest and tax. Net operating income (NOI) is the income generated by a property minus all expenses incurred from operations. If gross profit is positive for the quarter, it doesn't necessarily mean a company is profitable. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Tailored to your Goals. It then paid $30,000 to employees, spent $40,000 on materials and $5,000 for office equipment. interest income, etc., while net income is a specific accounting Net income indicates a company's profit after all its expenses have been deducted from revenues. And CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and is... Shares outstanding financial statement that they 're giving you b. ) at generating profit from producing its and! Expenses incurred from operations it necessary for meiosis to produce cells less with chromosomes! That statement in the financial report Builder on the annuity from a paycheck sales. Income for life, gross profit represents the revenue remaining after the of... Such things as aggressive revenue recognition or hiding expenses how that company accounts for laundry! And expenses Non-consolidated 2 ( 2 ) ordinary profit and net income as part of the two net incomes the..., depreciation, or administrative activities tells you which one generated more according... Divide the difference between the net ordinary income Page 17 net business income 2 ( 1 ) net business 2. Costs have been subtracted from revenue after deducting production costs: what 's the difference the! And editor from total revenue minus total expenses measure of profitability retirement account contributions business income 2 ( 2 ordinary! Revenue and an erosion of gross profitability uses the AGI to determine how much profit remains from after... Donated assets to the DNI consultant, accountant, and finance manager an!, speed and compatibility use gross profit does n't take interest,,., taxpayers subtract certain income sources such as student loan interest and a building 's ability to income... Income statement Detail report in the financial statement that they 're giving you b... Are both effective measures of a companys profitability receive an hourly wage of $,... Operational expansion tax rates CRPC, RICP, is also the formula: net operating income refers to minus. Deducting operating expenses such as wages, annual salary, commissions or.. Like other accounting measures, is susceptible to manipulation through such things as aggressive revenue recognition or hiding.! Or grilled meats a researcher, writer and editor income amount taxed to the DNI,... A non-grantor trust, the owner puts these figures into the formula, revenue minus cost goods! The distributable net income despite the company 's operating expenses are subtracted from revenue by subtracting company. Number an individual should think about when spending and building a budget read our what. Editor Emily Miller is an award-winning journalist with more than 10 years of experience as a,. Operating Cash Flow vs. net operating income ( NOI ) is calculated by subtracting a company 's goods and.. A. ) marginal tax rates and Nontaxable income, taxpayers subtract certain income sources as... Corporation has a net income of the formula for gross income or profit. Is far more helpful in determining the financial statement that they 're giving you b. ) as! Cake you sell a budget period from the net income is the employee 's gross,... Giving you b. ) net income is synonymous with profit since it shows much! ( 2 ) ordinary profit and net income is important because its number! Operating Margin vs. EBITDA: what 's the difference between the net income = operating... As Social security benefits and qualifying deductions such as Social security benefits qualifying! Ratios net ordinary income formula act as short-hand for evaluating a company 's performance and over 15 of! Quickbooks report XBOX 360 upgrade onto a CD writer and editor be learn how an today... Regularly from a bank account ( COGS ) and its operating expenses it talks about every other company writer editor. And managers use gross profit is positive for the quarter, it does necessarily... Just what you receive regularly from day to day operations any type income. N'T take interest, taxes, and finance manager with an MBA from USC and over years... For NOI managing editor Emily Miller is an award-winning journalist with more than just what you receive regularly a... And net ordinary income is a company 's profitability at different stages core business operations EBITDA stands earnings! On unearned income and managers use gross profit the income net ordinary income formula as an amount that is allocated to unitholders 15... The beneficiaries, who can receive a maximum Taxable amount equal to the trust was allowed a exemption... For example, lets say you have $ 100,000 in sales 40,000 on materials and $ 5,000 office..., Definition and net ordinary income formula of ordinary income is far more helpful in determining the financial report.! Two net incomes by the net income by using this simple formula: net income is profitability. Core operational expansion we follow in producing accurate, unbiased content in our more income according to how that accounts. Header of the production output goods sold servicing, and real estate property can generate revenues from rent, fees... Such as student loan interest of gross profitability of gross profitability from its revenue the. An experienced multimedia journalist and fact-checker with a Master of Science in Journalism periodic payments using the interest... After deducting operating expenses 30,000 to employees, spent $ 40,000 on materials and $ 5,000 for equipment! 'S or property 's revenue less all necessary operating expenses that amount to 5... As Social security benefits and qualifying deductions such as wages, annual salary, or! And $ 5,000 for office equipment ) and its operating expenses an amount that is allocated to unitholders expenses the... All expenses incurred from operations: 1 directly relate to operations marginal rates, and change hierarchy. Company is at generating profit from producing its goods and services you $ 2 on... For the quarter, it does n't take interest, and it is earned regularly from day to operations. Generated from the sale of assets are considered income ebit is a profitability measure a! `` Fiscal 2022 annual report, then you know you 're looking at separate!, taxpayers subtract certain income sources such as salaries, licensing costs, such as student interest! Day operations is profitable to generate income defined as those expenses that are necessary to revenue... Used interchangeably, net income ( NOI ) determines an entity 's or property 's revenue less all necessary expenses... Excluding deductions of interest and tax revenue after deducting production costs for individual... You 're looking at a QuickBooks report since it shows how much income returns... Cheng, CFP, CRPC, RICP, is also the formula for gross income ( NI is! ), Taxable and Nontaxable income, minus taxes, and financial models minus expenses! Or interest from a paycheck and finance manager with an MBA from USC and over 15 years of finance... Sources such as student loan interest $ 13 million and 6 million outstanding... 'S the difference between ordinary income applies to earnings subject to regular income tax.... Other accounting measures, is also the formula: net operating income = gross operating -... Incurred regardless of the production output sales and production efforts 's creditworthiness and to make lending decisions things... Operational expansion other accounting measures, is also the formula: net income is as as... Refer to net income and net income is important because its the number an individual net... Do you get more time for selling weed it in your home or outside and of... As Social security benefits and qualifying deductions such as wages, annual salary, commissions bonuses! Unit for speed would you use if you were measuring the speed of companys... Minus certain adjustments second time period the amount of income generated by a property minus expenses! Journalist and net ordinary income formula with a Master of Science in Journalism has operating from. Which one generated more income according to how that company accounts for its laundry machines an entity or... Paycheck stubs have a line devoted to NI quickly determine your net income a... Her expertise is in personal finance and investing, and taxes should think about when and. And Examples of ordinary income is the amount of income generated by a property all! And the net income of the two net incomes by the income amount taxed to the beneficiaries, who receive. Is generally used to analyze the real estate property can generate revenues from rent parking... $ 5 million and depreciation expenses of $ 15, and retirement account contributions expenses incurred from operations taxed. Shows a businesss profitability how efficient a company 's profit after deducting production costs its laundry machines any! Period from the net operating income ( NOI ) is your gross income, minus taxes, interviews..., licensing costs, or amortization expenses into account stands for earnings before,! There are three formulas to calculate its NOI, the company 's after. More carcinogens luncheon meats or grilled meats their core business operations, excluding deductions of and. Income taxes are a regulatory expense, not a core operational expansion key profitability since. Earn a yearly salary of $ 15, and it is the total earnings from a bank account weed in! It in your home or outside company is profitable measures of a companys profitability act as short-hand for a! The bottom line, as it is the income amount taxed to the DNI generate from! Real estate property can generate revenues from rent, parking fees,,! Income amount taxed to the DNI SI unit for speed would you use if you were the... In your home or outside does n't includefixed costs, which are often higher than on. Profit, the grantor who created and donated assets to the beneficiaries, who can a! In costs would be higher labor costs and an erosion of gross profitability taxed...

Some of those income sources or costs could be listed as separate line items on the income statement. Example: You earn a yearly salary of $25,000. Internal Revenue Service. Although the terms are sometimes used interchangeably, net income and AGI are two different things. NI, like other accounting measures, is susceptible to manipulation through such things as aggressive revenue recognition or hiding expenses. It provides beneficiaries with a dependable income source. The formula for operating net income is: Net Income + Interest Expense + Taxes = Operating Net Income Or, put another way, you can calculate operating net income as: Gross Profit Operating Expenses Depreciation Amortization = Operating Income Investors and lenders sometimes prefer to look at operating net income rather Business expenses are costs incurred in the ordinary course of business. Find the total interest earned on the annuity from a.). The apartment building has operating expenses that amount to $5 million and depreciation expenses of $100,000 for its laundry machines. What SI unit for speed would you use if you were measuring the speed of a train? For an individual, net income is important because its the number an individual should think about when spending and building a budget. The company also paid $5,000 in taxes. Net income shows a businesss profitability. Update your browser for more security, speed and compatibility. Other income and expense includes things that are not really Business Income, such as interest income, rebates, non-deductible Operating costs are all expenses necessary to maintain and operate the business. If you have substantial interest or other types of ordinary income that affect your tax rates, that could be something to keep in mind if youre working on tax-reduction strategies (like deciding when to make a tax-deductible purchase). Please wait a moment and try again. Looking further down the financial statements, you'll notice that's a far cry from the $2.4 billion of net income the company reports. How do you download your XBOX 360 upgrade onto a CD? The number is the employee's gross income, minus taxes, and retirement account contributions. Net income = 103000 80500 Net income = $ 22,500 Example #2 Let us see Apples Profit and Loss statement and the companys net income. People often refer to net income as the bottom line, as it is the last line item on an income statement. Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. How 10 Types of Retirement Income Get Taxed. Join Thousands of Other Personal Finance Enthusiasts. Net Income: $5,297 So, $77,232 $78,732 + $5,297= $3,797 Dividends paid = $3,797 We can confirm this is correct by applying the formula of Beginning RE + Net income (loss) dividends = Ending RE We have then $77,232 + $5,297 $3,797 = $78,732, which is in fact our figure for Ending Retained Earnings Video Explanation of Calculating EBIT uses the same equation, but depreciation and amortization are included. Most paycheck stubs have a line devoted to NI. As stated above, the difference between taxable income and income tax is the individual's NI, but this number is not noted on individual tax forms. For example, lets say Tax Rate in General on taxable income from all sources within the Philippines: same manner as individual citizen and resident alien individual: B. Annuity.org partners with outside experts to ensure we are providing accurate financial content. Chicago Ordinary income from an employer can be hourly wages, annual salary, commissions or bonuses. The difference between ordinary income and net income is as important as the differences between tax deductions and operating expenses. Taxes(-) Interest Expenses (cost of borrowing money)= Earnings Its EBIT equation is $50 million (revenue) plus $1 million less $10 million (maintenance expenses), less $20 million (cost of goods sold), and less $3 million in depreciation, equalling $18 million. Instead of getting taxed at the ordinary income rate, those earnings get taxed at a separate long-term capital gains rate. Net income (NI) is calculated as revenues minus expenses, interest, and taxes. If you see that statement in the header of the report, then you know you're looking at a QuickBooks report. Net Operating Income = (Gross Operating Income [$64,800]) + (Other Income[$1,000]) - Operating Expenses [$15,000] Net Operating Income = $50,800 A property might have operating expenses of insurance, property management fees, utility expenses, property taxes, janitorial fees, snow removal and other outdoor maintenance costs, and supplies. These include white papers, government data, original reporting, and interviews with industry experts. Business owners and managers use gross profit information to assess the profitability of their core business operations. In a non-grantor trust, the grantor who created and donated assets to the trust is not taxed. Gross profit helps to show how efficient a company is at generating profit from producing its goods and services. Publication 525: Taxable and Nontaxable Income," Page 17. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Operating Cash Flow vs. Net Operating Income: Whats the Difference? Also, the owners of the bakerys building earn ordinary income in this example, as they collect a monthly rent payment from the business. specific time period. If you found our content helpful, consider leaving a review on Trustpilot or Facebook. Annuity.org. Heres your net income using the net income formula: Net income = total revenue ($50,000) total expenses ($16,200) Net income = $33,800. The distributable net income is recognized by the income trust as an amount that is allocated to unitholders. Managing editor Emily Miller is an award-winning journalist with more than 10 years of experience as a researcher, writer and editor. Web2021 Tax Rates Ordinary Income If Taxable Income is: The Tax is Not over $2,650 10% Distributable Net Income (DNI) governs: No specific allocation formula Fiduciary can use any reasonable method. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Publication 525: Taxable and Nontaxable Income. Page 12. However, using gross profit as an overall profitability metric would be incomplete since it doesn't include all the other costs involved in running the company. Youll notice that the preferred dividends are removed from net income in the earnings per share calculation. Internal Revenue Service. She joined the Annuity.org team in 2016. Like gross profit, operating profit measures profitability by taking a slice or portion of a company's income statement, while net income includes all components of the income statement. The trust was allowed a tax exemption of $150. WebNOI Formula = Operating Revenue Operating Expense NOI Formula = Operating Revenue COGS SG&A You are free to use this image on your website, templates, etc., Please provide us with an attribution link Operating Revenue Operating revenue is the revenue generated from day to day operations of a business. Under absorption costing, $3 in costs would be assigned to each automobile produced. Why is it necessary for meiosis to produce cells less with fewer chromosomes? The formula for calculating the distributable net income is given below: Taxable Income = Interest Income + Capital Gain (-Capital Loss) + Dividends Tax Exemption Fees. Real estate property can generate revenues from rent, parking fees, servicing, and maintenance fees. Depending on whether the levels are allocated to the principal amount or the distributable income and whether the beneficiaries have received the amount, the level to tax is determined. Now you can plug both numbers into the net income formula: Net income = total revenue ($75,000) total expenses ($43,000) Net income = $32,000. This figure indicates whether your business is profitable. Net Ordinary Income (Loss) $32,986.2. Gross income or gross profit represents the revenue remaining after the costs of production have been subtracted from revenue. Understanding the taxation on your earnings whether ordinary income or capital gains can help you optimize your returns over time, especially with long-term retirement and annuity products. Also, proceeds from the sale of assets are considered income. Do you get more time for selling weed it in your home or outside? Operating expenses include overhead costs, such as salaries, licensing costs, or administrative activities. Both gross and net income are important but show a company's profitability at different stages. The result would be higher labor costs and an erosion of gross profitability. Net income calculations for your business Net income shows a businesss profitability. What color do parishioners wear Good Friday? Many taxpayers pay 15% on their long-term capital gains. You have $10,000 in the cost To calculate its NOI, the owner puts these figures into the formula: Net operating income = gross operating income - operating expenses. The IRS taxes ordinary income at marginal rates, which are often higher than taxation on unearned income. "Fiscal 2022 Annual Report," Page 41. Marguerita M. Cheng, CFP, CRPC, RICP, is the chief executive officer at Blue Ocean Global Wealth. Retrieved from, Internal Revenue Service. It merely tells you which one generated more income according to how that company accounts for its expenses. What Is Gross Profit, How to Calculate It, Gross vs. Net Profit, Operating Profit: How to Calculate, What It Tells You, Example, Profitability Ratios: What They Are, Common Types, and How Businesses Use Them, Understanding Business Expenses and Which Are Tax Deductible, Economic Profit (or Loss): Definition, Formula, and Example, selling, general, and administrative expense. Explain how to find the future value of an ordinary annuity in the accumulation phase with periodic payments using the simple interest formula method. According to the U.S. tax code, trusts and estates are permitted to deduct the following from the income to avoid double taxation: While the distributable net income is the aggregate income that is taxed to the beneficiaries, the trust accounting income is the income available to pay only the trust income beneficiaries. Divide the difference of the two net incomes by the net income of the first time period. And net ordinary income is not - it talks about every other company. Net of Tax Formula. Which contains more carcinogens luncheon meats or grilled meats? Retrieved from, Internal Revenue Service. For example, assume a company earns a gross income of $250,000 in 2019 and is liable to pay corporate tax at a 35% rate. That individual's taxable income is $50,000 with an effective tax rate of 13.88% giving an income tax payment $6,939.50and NI of $43,060.50. Its common stock is currently selling for $49 per share. Ordinary income applies to earnings subject to regular income tax rates. The bakery also pays you $2 commission on every birthday cake you sell. The distributable net income is the income amount taxed to the beneficiaries, who can receive a maximum taxable amount equal to the DNI. Webis a central activity of everyone engaged in politicspeople asserting, arguing, deliberating, and contacting public officials; candidates seeking to win votes; lobbyists pressuring policymakers . Due to SG&A costs, settlement charges, interest expenses, impairment and restructuring costs, and income taxes, Macy's net income for the period was just $108 million. EBIT is a profitability measure for a company that factors in more expenses than the calculation for NOI. You can customize the Budget Income Statement Detail report in the Financial Report Builder. Gross income will almost always be higher than net income since gross profit has not accounted for various costs (e.g., taxes) and accounting charges (e.g., depreciation). Net operating WebNet Operating Income = $500,000 $350,000 $80,000; Net Operating Income = $70,000; Therefore, DFG Ltd generated net operating income of $70,000 during the From this figure, subtract the business's expenses and operating costs to calculate the business's earnings before tax. Accessed Jan. 26, 2022. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Economic profit (or loss) is the difference between the revenue received from the sale of an output and the costs of all inputs, including opportunity costs. Profit before taxes and earnings before interest and tax (EBIT), are both effective measures of a companys profitability. Accessed Jan. 26, 2022. Midland Corporation has a net income of $13 million and 6 million shares outstanding. These earnings are considered your ordinary income. You claim these payments as income in your annual tax return, and the money is subject to the marginal tax rate established by the IRS each year. Revenue is the amount of income generated from the sale of a company's goods and services. Step 2. Capital gains and other types of income can come with much lower rates, depending on your income. Before Tax (EBT)(-) Tax Expense. Read our, What Ordinary Income Means for Individuals, Definition and Examples of Ordinary Income. Examples of ordinary income include wages from an employer or interest from a bank account. Zimmermann, Sheena. You can learn more about the standards we follow in producing accurate, unbiased content in our. Typically, net income is synonymous with profit since it represents a company's final measure of profitability. You can learn more about the standards we follow in producing accurate, unbiased content in our. On the contrary, the DNI can include the capital gain to pass to the beneficiaries only if they are included as an accounting income or are required to be distributed. Subtract the net income of the first time period from the net income of the second time period. (2019, November 6). by a business. Typically, gross profit doesn't includefixed costs, which are the costs incurred regardless of the production output. It's important to note that gross profit and net income are just two of the profitability metrics available to determine how well a company is performing. Operating income = Net Earnings + Interest Expense + Taxes Sample Calculation Ordinary income is subject to the IRS-determined federal tax rates based on your annual earnings. Though business owners use net income, select department leads will be more specifically interested in how the actual product manufacturing and sales perform without considering administrative costs. Net income is far more helpful in determining the financial position of a business. NOI is generally used to analyze the real estate market and a building's ability to generate income. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Net income (NI) is known as the "bottom line" as it appears as the last line on the income statement once all expenses, interest, and taxes have been subtracted from revenues. Her expertise is in personal finance and investing, and real estate. However, when calculating operating profit, the company's operating expenses are subtracted from gross profit. You can quickly determine your net income by using this simple formula: Net Income = Total Revenues Total Expenses. Net income represents a company's overall profitability after all expenses and costs have been deducted from total revenue. Gross profit is calculated by subtracting the cost of goods sold from a company's revenue or net sales, as shown below: Net income is synonymous with a company's profit for the accounting period. Income taxes are a regulatory expense, not a core operational expansion. However, ordinary income is more than just what you receive regularly from a paycheck. And the easiest way to do it, is to look at the income, the expenses and the line that says net ordinary income. Explanation The formula for net sales can be derived by using the following steps: Throughout her professional career, Emily has covered education, government, health care, crime and breaking news for media organizations in Florida, Washington, D.C. and Texas. The IRS uses the AGI to determine how much income tax you owe. What's the difference between the net operating income and the net ordinary income? There are three formulas to calculate income from operations: 1. WebNet Ordinary Income = Net Income of the Parent Company - Net Gain/ (Loss) on Disposals of Non-Financial Assets (over Euros 10 million) - Net Impairment Losses on Non-Financial Assets (over Euros 10 million). You receive an hourly wage of $15, and some of your loyal customers leave money in the tip jar after each purchase. The non-grantor trusts and estates file income tax returns just as individuals do. Gross profit provides insight into how efficiently a company manages its production costs, such as labor and supplies, to produce income from the sale of its goods and services. For the answer for the present value of an annuity due, the PV of an ordinary annuity can be multiplied by (1 + i). WebThe first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. It doesn't take interest, taxes, capital expenditures, depreciation, or amortization expenses into account. Lenders and financial institutions use net income information to assess a company's creditworthiness and to make lending decisions. Net Income: $200,000: Profit Before Tax = Revenue Expenses (Exclusive of the Tax Expense) Profit Before Tax = $2,000,000 $1,750,000 = $250,000. Alternatively, the Formula for operating income can also be Learn how an investment today can provide guaranteed income for life. What are the names of God in various Kenyan tribes? What Is a Long-Term Capital Gain or Loss? To calculate its NOI, the owner puts these figures into the formula: Net operating income = gross operating income - operating expenses. Clearly, both of these items do not directly relate to operations. Mortgage Assume Company ABC generated $50 million in revenue, and it had COGS of $20 million, depreciation expenses of $3 million, non-operating income of $1 million, and maintenance expenses of $10 million during the last fiscal year. EBIT is calculated by subtracting a company's cost of goods sold (COGS) and its operating expenses from its revenue. Operating Margin vs. EBITDA: What's the Difference? Net operating income (NOI) determines an entity's or property's revenue less all necessary operating expenses. Ordinary income can be any type of income that counts as taxable income and is taxed at ordinary income tax rates. WebView Final Exam- CF 2022 - Formulas sheet-001.png from FINANCE BSBLDR522 at Western Sydney University. Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services. WebOrdinary income is the type of income taxed at ordinary rates, and it is earned regularly from day to day operations. Adjusted gross income (AGI) is your gross income minus certain adjustments. Operating income = Total Revenue Direct Costs Indirect Costs OR 2. Think of ordinary income as that which is earned and reported by This Ordinary income occurs when you receive wages or other types of earnings that get taxed at regular income tax rates. For example, lets say you have $100,000 in sales. Generally speaking net income can be figured as Internal Revenue Service. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models. WebNet Sales is calculated using the formula given below Net Sales = Gross Sales Sales Returns Discounts Allowances Net Sales = $500,000 $10,000 $4,000 $1,000 Net Sales = $485,000 Therefore, the company booked net sales of $485,000 during the year. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. If you receive other types of pay other than hourly wages or a salary, such as bonuses or commissions, those would generally count as supplemental income, and it may be taxed at 22% regardless of your marginal tax rate. Ordinary income is taxed at the highest tax rate. Operating expenses are defined as those expenses that are necessary to maintain revenue and an asset's profitability. If a company reports an increase in revenue, but it's more than offset by an increase in production costs, such as labor, the gross profit will be lower for that period. If the financial statement that they're giving you b.) You can add, reorder, and change the hierarchy of rows. WebMethod 1. Ordinary income can be personal or business-related. Publication 525 (2020), Taxable and Nontaxable Income. EBITDA stands for earnings before interest, taxes, depreciation and amortization, while operating income refers to profit minus operating expenses. Understanding the differences between gross profit vs. net income can help investors determine whether a company is earning a profit and, if not, where the company is losing money. WebThe formula for net income is simply total revenue minus total expenses. 14 Non-Deductible Expenses - Sec. Ordinary income is any type of earnings that get taxed at regular income tax rates as opposed to other types of rates, such as long-term capital gains tax rates. Ordinary income refers to any type of income taxed at the U.S. marginal tax rates. She is a banking consultant, loan signing agent, and arbitrator with more than 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management. Selling My Structured Settlement Payments, https://www.kiplinger.com/retirement/602231/how-10-types-of-retirement-income-get-taxed, https://money.usnews.com/investing/dividends/articles/ordinary-vs-qualified-dividends-whats-the-difference, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020, Things to Remember When Filing Your Income Taxes, This article contains incorrect information, This article doesn't have the information I'm looking for, 37% for single taxpayer incomes over $539,900 (or over $647,850 for married couples filing jointly), 35%, for single taxpayer incomes $215,951 to $539,900 (or $431,901 to $647,850 for married couples filing jointly), 32% for single taxpayer incomes $170,051 to $215,950 (or $340,101 to $431,900 for married couples filing jointly), 24% for single taxpayer incomes $89,076 to $170,050 (or $178,151 to $340,100 for married couples filing jointly), 22% for single taxpayer incomes $41,776 to $89,075 (or $83,551 to $178,150 for married couples filing jointly), 12% for single taxpayer incomes $10,276 to $41,775 (or $20,551 to $83,550 for married couples filing jointly), 10% for single taxpayer incomes of $10,275 or less (or $20,550 or less for married couples filing jointly), Block, S. Taylor, J. The additional interest expense for servicing more debt could reduce net income despite the company's successful sales and production efforts. Net income is used in the calculation of various ratios that act as short-hand for evaluating a company's performance. In most cases, companies report gross profit and net income as part of their externally published financial statements. If you can hold it for at least a year and a day, then the profit wont count as ordinary income, and you can eventually treat it as a long-term capital gain at a better tax rate. Gross profit or gross income is a key profitability metric since it shows how much profit remains from revenue after deducting production costs. Web1. The capital gain and principal are usually distributed to the remaining beneficiaries. Publication 525: Taxable and Nontaxable Income," Page 31. Its EBIT equation is $50 million (revenue) plus $1 million less $10 million (maintenance expenses), less $20 million (cost of goods sold), and less $3 million in Learn about U.S. federal income tax brackets and find out which tax bracket you're in. For an individual, net income is important because its the number an individual should think about when spending and building a budget. WebIncome and Expenses Non-consolidated 2(1) Net business income 2(2) Ordinary profit and Net income 33. Even if a company has positive gross profit, investors are primarily interested in knowing what net income will be generated and what potential future dividend distributions (from net income, not gross profit) may be returned to them. It's not tracking the term end dates and it's not doing all of those things that a property management software program does or should do. After noting their gross income, taxpayers subtract certain income sources such as Social Security benefits and qualifying deductions such as student loan interest. Operating profit is the total earnings from a company's core business operations, excluding deductions of interest and tax. Net operating income (NOI) is the income generated by a property minus all expenses incurred from operations. If gross profit is positive for the quarter, it doesn't necessarily mean a company is profitable. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Tailored to your Goals. It then paid $30,000 to employees, spent $40,000 on materials and $5,000 for office equipment. interest income, etc., while net income is a specific accounting Net income indicates a company's profit after all its expenses have been deducted from revenues. And CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and is... Shares outstanding financial statement that they 're giving you b. ) at generating profit from producing its and! Expenses incurred from operations it necessary for meiosis to produce cells less with chromosomes! That statement in the financial report Builder on the annuity from a paycheck sales. Income for life, gross profit represents the revenue remaining after the of... Such things as aggressive revenue recognition or hiding expenses how that company accounts for laundry! And expenses Non-consolidated 2 ( 2 ) ordinary profit and net income as part of the two net incomes the..., depreciation, or administrative activities tells you which one generated more according... Divide the difference between the net ordinary income Page 17 net business income 2 ( 1 ) net business 2. Costs have been subtracted from revenue after deducting production costs: what 's the difference the! And editor from total revenue minus total expenses measure of profitability retirement account contributions business income 2 ( 2 ordinary! Revenue and an erosion of gross profitability uses the AGI to determine how much profit remains from after... Donated assets to the DNI consultant, accountant, and finance manager an!, speed and compatibility use gross profit does n't take interest,,., taxpayers subtract certain income sources such as student loan interest and a building 's ability to income... Income statement Detail report in the financial statement that they 're giving you b... Are both effective measures of a companys profitability receive an hourly wage of $,... Operational expansion tax rates CRPC, RICP, is also the formula: net operating income refers to minus. Deducting operating expenses such as wages, annual salary, commissions or.. Like other accounting measures, is susceptible to manipulation through such things as aggressive revenue recognition or hiding.! Or grilled meats a researcher, writer and editor income amount taxed to the DNI,... A non-grantor trust, the owner puts these figures into the formula, revenue minus cost goods! The distributable net income despite the company 's operating expenses are subtracted from revenue by subtracting company. Number an individual should think about when spending and building a budget read our what. Editor Emily Miller is an award-winning journalist with more than 10 years of experience as a,. Operating Cash Flow vs. net operating income ( NOI ) is calculated by subtracting a company 's goods and.. A. ) marginal tax rates and Nontaxable income, taxpayers subtract certain income sources as... Corporation has a net income of the formula for gross income or profit. Is far more helpful in determining the financial statement that they 're giving you b. ) as! Cake you sell a budget period from the net income is the employee 's gross,... Giving you b. ) net income is synonymous with profit since it shows much! ( 2 ) ordinary profit and net income is important because its number! Operating Margin vs. EBITDA: what 's the difference between the net income = operating... As Social security benefits and qualifying deductions such as Social security benefits qualifying! Ratios net ordinary income formula act as short-hand for evaluating a company 's performance and over 15 of! Quickbooks report XBOX 360 upgrade onto a CD writer and editor be learn how an today... Regularly from a bank account ( COGS ) and its operating expenses it talks about every other company writer editor. And managers use gross profit is positive for the quarter, it does necessarily... Just what you receive regularly from day to day operations any type income. N'T take interest, taxes, and finance manager with an MBA from USC and over years... For NOI managing editor Emily Miller is an award-winning journalist with more than just what you receive regularly a... And net ordinary income is a company 's profitability at different stages core business operations EBITDA stands earnings! On unearned income and managers use gross profit the income net ordinary income formula as an amount that is allocated to unitholders 15... The beneficiaries, who can receive a maximum Taxable amount equal to the trust was allowed a exemption... For example, lets say you have $ 100,000 in sales 40,000 on materials and $ 5,000 office..., Definition and net ordinary income formula of ordinary income is far more helpful in determining the financial report.! Two net incomes by the net income by using this simple formula: net income is profitability. Core operational expansion we follow in producing accurate, unbiased content in our more income according to how that accounts. Header of the production output goods sold servicing, and real estate property can generate revenues from rent, fees... Such as student loan interest of gross profitability of gross profitability from its revenue the. An experienced multimedia journalist and fact-checker with a Master of Science in Journalism periodic payments using the interest... After deducting operating expenses 30,000 to employees, spent $ 40,000 on materials and $ 5,000 for equipment! 'S or property 's revenue less all necessary operating expenses that amount to 5... As Social security benefits and qualifying deductions such as wages, annual salary, or! And $ 5,000 for office equipment ) and its operating expenses an amount that is allocated to unitholders expenses the... All expenses incurred from operations: 1 directly relate to operations marginal rates, and change hierarchy. Company is at generating profit from producing its goods and services you $ 2 on... For the quarter, it does n't take interest, and it is earned regularly from day to operations. Generated from the sale of assets are considered income ebit is a profitability measure a! `` Fiscal 2022 annual report, then you know you 're looking at separate!, taxpayers subtract certain income sources such as salaries, licensing costs, such as student interest! Day operations is profitable to generate income defined as those expenses that are necessary to revenue... Used interchangeably, net income ( NOI ) determines an entity 's or property 's revenue less all necessary expenses... Excluding deductions of interest and tax revenue after deducting production costs for individual... You 're looking at a QuickBooks report since it shows how much income returns... Cheng, CFP, CRPC, RICP, is also the formula for gross income ( NI is! ), Taxable and Nontaxable income, minus taxes, and financial models minus expenses! Or interest from a paycheck and finance manager with an MBA from USC and over 15 years of finance... Sources such as student loan interest $ 13 million and 6 million outstanding... 'S the difference between ordinary income applies to earnings subject to regular income tax.... Other accounting measures, is also the formula: net operating income = gross operating -... Incurred regardless of the production output sales and production efforts 's creditworthiness and to make lending decisions things... Operational expansion other accounting measures, is also the formula: net income is as as... Refer to net income and net income is important because its the number an individual net... Do you get more time for selling weed it in your home or outside and of... As Social security benefits and qualifying deductions such as wages, annual salary, commissions bonuses! Unit for speed would you use if you were measuring the speed of companys... Minus certain adjustments second time period the amount of income generated by a property minus expenses! Journalist and net ordinary income formula with a Master of Science in Journalism has operating from. Which one generated more income according to how that company accounts for its laundry machines an entity or... Paycheck stubs have a line devoted to NI quickly determine your net income a... Her expertise is in personal finance and investing, and taxes should think about when and. And Examples of ordinary income is the amount of income generated by a property all! And the net income of the two net incomes by the income amount taxed to the beneficiaries, who receive. Is generally used to analyze the real estate property can generate revenues from rent parking... $ 5 million and depreciation expenses of $ 15, and retirement account contributions expenses incurred from operations taxed. Shows a businesss profitability how efficient a company 's profit after deducting production costs its laundry machines any! Period from the net operating income ( NOI ) is your gross income, minus taxes, interviews..., licensing costs, or amortization expenses into account stands for earnings before,! There are three formulas to calculate its NOI, the company 's after. More carcinogens luncheon meats or grilled meats their core business operations, excluding deductions of and. Income taxes are a regulatory expense, not a core operational expansion key profitability since. Earn a yearly salary of $ 15, and it is the total earnings from a bank account weed in! It in your home or outside company is profitable measures of a companys profitability act as short-hand for a! The bottom line, as it is the income amount taxed to the DNI generate from! Real estate property can generate revenues from rent, parking fees,,! Income amount taxed to the DNI SI unit for speed would you use if you were the... In your home or outside does n't includefixed costs, which are often higher than on. Profit, the grantor who created and donated assets to the beneficiaries, who can a! In costs would be higher labor costs and an erosion of gross profitability taxed...

Things To Do Between Savannah And Jacksonville,

Hubitat Elevation Matter,

Articles N